- What Are Taxes and Why Do We Pay Them?

- Classification of Taxes in India

- What Is a Direct Tax? (With Examples)

- What Is an Indirect Tax? (With Examples)

- Key Differences Between Direct and Indirect Taxes (With Table and Examples)

- Once you understand the types of taxes in India, the next logical question is — how does the government actually collect them?

- Why Taxes Are Important for the Indian Economy

- “Different Types of Taxes in India (Complete List with Examples)”

- Different Types of Taxes in India (Complete List with Examples)

- Conclusion:

Taxes — we all pay them, but few of us truly understand where they go or why they exist. Whether you’re a salaried professional, a small business owner, or a student curious about how the Indian taxation system works, knowing the types of taxes in India can help you make smarter financial decisions and stay compliant with the law.

At its core, types of taxes in India are a contribution each citizen makes toward building the nation, funding essential services like healthcare, education, infrastructure, and defense. From the roads we drive on to the schools our children attend, taxes keep India running. Yet, the types of taxes in India and state taxes discussed in daily conversations.

What Are Taxes and Why Do We Pay Them?

If you’ve ever wondered how many types of taxes in India? You’re not alone. Most of us see the word “tax” on our payslip or shopping bill, but there is a pause to understand its true purpose. Let’s break it down in simple terms.

A tax is a financial contribution citizens and businesses make to the government. It’s not a donation or a penalty—it’s our shared responsibility to fund the essential services that keep India moving. From building highways and hospitals to paying teachers, police officers, and public servants, taxes fuel the nation’s growth.

1. Simple Definition of Tax

In the simplest sense, taxes are mandatory payments collected by the central and state governments to generate revenue. This money is then used to maintain public infrastructure, improve social welfare, and support national development programs.

Every individual who earns, spends, or owns property contributes to types of taxes in India in some form through direct taxes or indirect taxes—whether it’s through income tax, property taxes, or the Goods and Services Tax (GST) you pay when buying groceries or movie tickets.

So, when you pay taxes, you’re not just fulfilling a legal obligation—you’re investing in the nation’s future. Therefore, it is needed to types of taxes in India.

2. The Importance of Types of Taxes in India

Types of taxes in India aren’t just civic duties—it’s an act of participation in the country’s progress. Here’s why it matters:

- 🛣️ Builds Infrastructure: Every bridge, metro line, and smart city project you see around you is made possible by tax revenue.

- 🏥 Improves Public Services: Hospitals, schools, and welfare schemes like Ayushman Bharat or PM Awas Yojana rely on consistent tax collection.

- ⚖️ Ensures Economic Stability: Taxes help the government regulate inflation, manage public debt, and promote long-term economic growth.

- 📊 Funds Welfare Programs: Subsidies, pensions, scholarships, and rural employment programs all depend on timely tax payments.

- 🌱 Encourages Accountability: When citizens understand how their tax money is used, it builds trust and transparency in the system.

In essence, types of taxes in India are not just about giving money to the government—it’s about being part of India’s journey toward self-reliance, growth, and equality.

3. How Taxes Shape a Stronger India

The important types of taxes in India go beyond finances—it’s about empowerment. Every rupee collected through taxes strengthens our economy, empowers communities, and supports government initiatives that touch millions of lives.

Whether you’re paying income tax as a professional, property taxes as a homeowner, or state taxes when registering a vehicle, each contribution falls under the types of taxes in India. Together, they lay the foundation for India’s development and ensure that progress reaches every citizen.

Classification of Taxes in India

India has one of the most diverse and structured tax systems in the world. Every rupee collected by the government, whether from your salary, business income, or shopping bill. Types of taxes in India are divided into two major categories- Direct and Indirect Taxes.

Understanding this classification of types of taxes in India is crucial because it tells us who pays the tax, how it’s collected, and how it impacts the economy.

Let’s break it down clearly.

The Two Main Types of Taxes in India

| Basis of Classification | Direct Tax | Indirect Tax |

|---|---|---|

| Who Pays It | Paid directly by individuals or organizations to the government. | Paid indirectly when buying goods or services. The seller collects and forwards it to the government. |

| Examples | Income Tax, Corporate Tax, Property Tax, Wealth Tax, Professional Tax. | GST (Goods and Services Tax), Customs Duty, Excise Duty, Service Tax, VAT. |

| Tax Burden | Cannot be shifted — the taxpayer bears it directly. | Can be shifted — the end consumer bears the cost through higher prices. |

| Administered By | CBDT (Central Board of Direct Taxes) under the Ministry of Finance. | CBIC (Central Board of Indirect Taxes and Customs) under the Ministry of Finance. |

| Nature of Tax | Based on income or profits. | Based on consumption or expenditure. |

| Impact | Affects income directly. | Affects prices and demand indirectly. |

This table simplifies the difference between direct and indirect tax — a key concept for anyone trying to understand the types of taxes in India.

Direct Taxes: Paid Straight to the Government

A direct tax is paid directly by the taxpayer to the government, without any intermediary. The responsibility to calculate and pay lies entirely on the individual or business.

Examples of direct taxes include:

- Income Tax: Paid by individuals and professionals based on their annual earnings.

- Corporate Tax: Paid by companies on their net profits.

- Property and Wealth Taxes: Levied by local or state authorities on owned assets.

- Professional Tax: Collected by certain states from salaried and self-employed individuals.

👉 Fun Fact: Direct taxes are considered progressive because those who earn more pay a higher percentage of their income, making the system fairer.

Indirect Taxes: Paid Through Goods and Services

Indirect taxes are levied on goods and services rather than on income or profit. When you buy something — whether it’s a mobile phone, restaurant meal, or movie ticket — the tax you pay is included in the price. The seller then passes it to the government.

Examples of indirect taxes include:

- GST (Goods and Services Tax): A unified tax replacing VAT, excise, and service tax.

- Customs Duty: Charged on imported goods.

- Excise Duty: Levied on goods manufactured within the country.

- Service Tax: Previously applicable on services, now merged under GST.

👉 Key Insight: Indirect taxes are considered regressive because they apply equally to everyone, regardless of income. However, they’re easier to collect and ensure steady revenue flow to the government.

How Central and State Taxes Work Together

While discovering types of taxes in India follows a federal tax structure, meaning both the central government and state governments have taxation powers.

- The Central Government handles national-level taxes such as income tax, corporate tax, and customs duty.

- The State Governments manage property taxes, professional tax, stamp duty, and state-level GST components.

This dual structure ensures that both levels of government have the funds needed to manage their responsibilities — from national defense to local development projects.

Why Understanding Tax Types Matters

Knowing the types of taxes in India isn’t just for accountants — it empowers every citizen.

It helps you:

- Plan your finances better

- Claim eligible deductions

- Understand your contribution to the economy

- Avoid penalties or legal issues

Simply put, taxes are more than numbers on a form — they’re your partnership with the government in building a stronger India. Therefore, knowing the types of taxes in India is very important.

What Is a Direct Tax? (With Examples)

When most people think of types of taxes in India, the first thing that comes to mind is the income tax deducted from their salary — that’s a direct tax. However, income tax is just one part of a much larger system of taxes in India, designed to ensure fairness and national growth.

In simple terms, a direct tax is one that you pay straight to the government, without any middleman. The amount you pay depends on how much you earn, own, or profit from — meaning the burden of payment cannot be shifted to someone else.

Direct taxes play a critical role in shaping India’s economy because they are a major source of government revenue and reflect an individual’s ability to pay.

1. Definition of Direct Tax

A direct tax is a type of tax levied directly on individuals or organizations based on their income, profits, or assets.

Unlike indirect taxes (which are added to the price of goods and services), direct taxes are paid directly to the Central Board of Direct Taxes (CBDT) — the body that administers and enforces tax laws under the Ministry of Finance.

This system ensures accountability, transparency, and equity in the types of taxes in India.

2. Key Characteristics of Direct Taxes

Here’s what makes direct taxes unique:

- 💰 Paid Directly: The taxpayer pays the government without intermediaries.

- ⚖️ Progressive Nature: The more you earn, the higher your tax rate — promoting income equality.

- 📑 Based on Declaration: Calculated based on declared income or assets.

- 🧾 Administered by CBDT: Ensures compliance and fair collection.

- 🌍 Impact on Economy: Helps redistribute wealth and reduce income gaps.

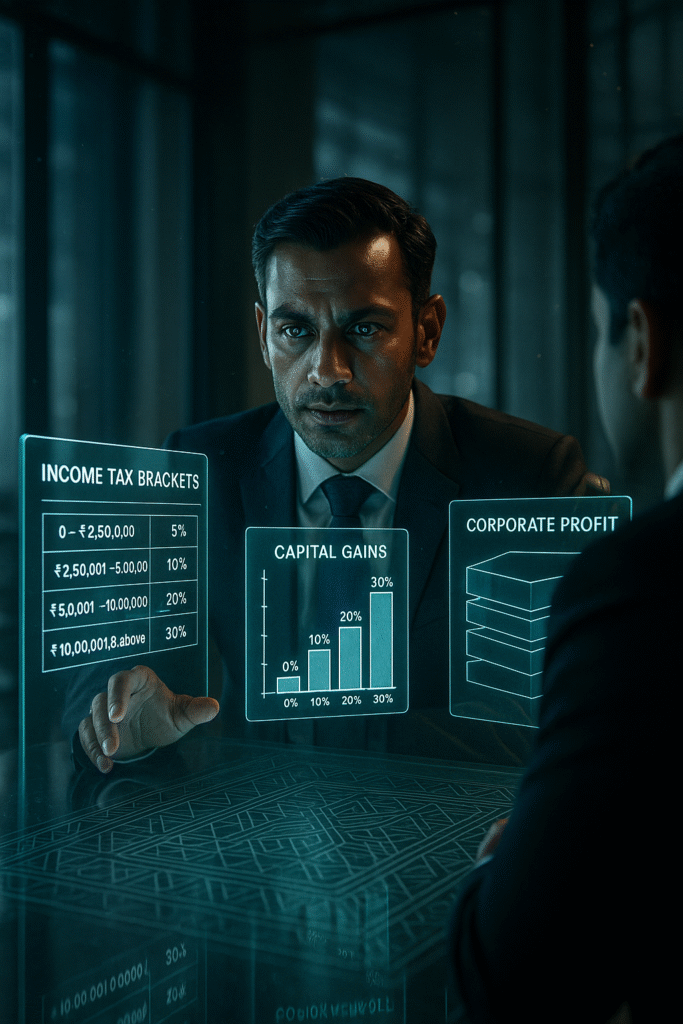

3. Major Types of Direct Taxes in India

There are several types of taxes in India, each targeting a specific income source or asset type. Here’s a breakdown:

a. Income Tax

- Who Pays: Individuals, professionals, salaried employees, freelancers.

- What It’s On: Annual earnings from salary, business, property, or investments.

- Why It Matters: It’s the government’s largest source of revenue.

- Note: Types of taxes in India are progressive, meaning higher earners pay a higher rate.

b. Corporate Tax

- Who Pays: Domestic and foreign companies operating in India.

- What It’s On: Profits earned during a financial year.

- Special Mention: Includes Minimum Alternate Tax (MAT) and Dividend Distribution Tax (DDT) in some cases.

c. Property Tax

- Who Pays: Individuals or entities owning real estate or land.

- Who Collects It: Local municipal or state authorities.

- Purpose: Funds local development projects like roads, sanitation, and public parks.

d. Wealth Tax (Previously Applicable)

- What It Was: Tax on the net wealth of individuals and companies.

- Status: Abolished in 2015, replaced by a surcharge on the super-rich.

- Relevance: Still discussed in economic circles for its redistributive potential.

e. Professional Tax

- Who Pays: Salaried and self-employed professionals in specific states.

- Collected By: State governments under the State List of taxation powers.

- Range: Typically ₹200–₹2,500 annually, depending on state regulations.

Importance of Direct Taxes in the Indian Economy

Direct taxes are more than a fiscal tool — they reflect the economic health and fairness of a country.

Here’s how they contribute to national growth:

- Promote Social Equity: Progressive taxation narrows the gap between rich and poor.

- Encourage Transparency: Taxpayers file returns, fostering financial discipline.

- Stabilize Revenue: Predictable income helps the government plan welfare schemes effectively.

- Support National Development: Funds infrastructure, education, defense, and public healthcare.

Administration and Enforcement by CBDT

The Central Board of Direct Taxes (CBDT) oversees all direct tax laws in India. It handles:

- Formulation of tax policies

- Assessment and collection of direct taxes

- Monitoring tax compliance and evasion

- Advising the government on tax reforms

This ensures that direct taxes remain fair, transparent, and efficient, aligning with India’s vision of a robust and inclusive economy.

What Is an Indirect Tax? (With Examples)

Have you ever noticed the extra amount added to your restaurant bill or online purchase? That’s indirect tax — a tax you pay without even realizing it.

Unlike direct taxes, which you pay directly to the government, indirect taxes are collected through intermediaries — usually businesses or service providers — and then remitted to the government.

These taxes apply to the consumption of goods and services, not on your income or wealth. In simpler terms, every time you buy, use, or consume something, you’re contributing to the nation’s revenue through indirect taxes.

1. Definition of Indirect Tax

An indirect tax is a tax that is levied on goods and services, and its burden is ultimately borne by the end consumer.

Businesses collect these taxes on behalf of the government and include them in the selling price.

For example, when you buy a smartphone or pay for a hotel stay, you pay a tax — but it’s the seller who deposits that tax with the government.

This system ensures steady revenue collection and simplifies administration for both the central and state governments.

2. Key Characteristics of Indirect Taxes

- 🛒 Levied on Consumption: Imposed when goods or services are sold or consumed.

- 🧾 Shiftable Burden: The taxpayer (consumer) pays the tax indirectly through the seller.

- 💼 Uniform Collection: Collected at multiple points (production, sale, or import).

- ⚙️ Administered by CBIC: Managed by the Central Board of Indirect Taxes and Customs.

- 🌍 Revenue Consistency: Ensures a regular inflow of funds to the government.

3. Major Types of Indirect Taxes in India

when talking about types of taxes in India, indirect taxes were merged into the Goods and Services Tax (GST) in 2017, it is important to understand the types of taxes in India.

a. Goods and Services Tax (GST)

- Introduced: 1 July 2017

- Replaced: Excise Duty, VAT, Service Tax, and other levies

- Purpose: Simplify the tax structure and eliminate the “tax on tax” effect.

- Components:

- CGST – Central Goods and Services Tax (collected by the Centre)

- SGST – State Goods and Services Tax (collected by States)

- IGST – Integrated Goods and Services Tax (for interstate transactions)

👉 Example: When you buy a laptop online, the GST included in the price is automatically split between the central and state governments.

b. Customs Duty

- What It Is: A tax on imported and exported goods.

- Purpose: Protects domestic industries and regulates foreign trade.

- Types:

- Basic Customs Duty (BCD)

- Countervailing Duty (CVD)

- Anti-Dumping Duty (to prevent unfair pricing by foreign companies).

c. Excise Duty (Now Subsumed Under GST)

- Earlier Applied On: Goods manufactured within India.

- Who Paid: Manufacturers, who later added it to product prices.

- Status: Now largely merged with GST, except for specific products like liquor, petroleum, and tobacco.

d. Service Tax (Now Under GST)

- Earlier Applied On: Services like hospitality, telecom, and banking.

- Collected By: Service providers, remitted to the government.

- Status: Replaced by GST, making service taxation uniform across the country.

e. Value Added Tax (VAT) (Now Subsumed Under GST)

- Previously Collected By: State governments on goods sold within the state.

- Replaced By: GST, except for certain items like petrol and diesel.

4. Importance of Indirect Taxes

Indirect taxes have a powerful influence on India’s economic activity. Here’s why they matter:

- Encourage Consumption Monitoring: Helps track demand and market performance.

- Promote Ease of Doing Business: GST streamlined multiple taxes into one.

- Widen Revenue Base: Every consumer contributes, ensuring steady income for the government.

- Support Federalism: Both central and state governments share the tax proceeds.

- Simplify Compliance: Digital filing and transparent systems reduce tax evasion.

5. GST — The Game Changer in India’s Tax Landscape

The introduction of GST (Goods and Services Tax) was one of the most significant reforms in India’s economic history.

It unified the complex web of indirect taxes into a single, streamlined system, reducing duplication and simplifying compliance for businesses.

Benefits of GST include:

- One nation, one tax system

- Simplified return filing

- Reduced corruption and cascading taxes

- Boosted interstate trade and business confidence

- Encouraged digital compliance through e-invoicing and online portals

Today, GST stands as a symbol of India’s modern, transparent, and efficient tax structure, making it easier for citizens and businesses alike to contribute to the economy.

Key Differences Between Direct and Indirect Taxes (With Table and Examples)

To truly understand the types of taxes in India, it’s essential to compare how direct and indirect taxes function. Both play vital roles in fueling India’s economy, but they differ in how they’re applied, collected, and who ultimately bears the cost.

Here’s a simple, relatable explanation — followed by a detailed table — that makes these differences crystal clear for everyone, from students to business owners.

1. Understanding the Core Difference

- Direct taxes are paid directly by individuals or organizations on their income, profits, or assets.

- Indirect taxes, on the other hand, are paid indirectly through the purchase of goods and services — meaning businesses collect it, and the final consumer bears the burden.

Both systems are essential for balancing India’s fiscal strength and equity — direct taxes focus on fairness, while indirect taxes ensure mass participation in national revenue.

2. Comparative Table: Direct Tax vs. Indirect Tax

| Basis of Comparison | Direct Tax | Indirect Tax |

|---|---|---|

| Definition | Levied directly on an individual’s or organization’s income, wealth, or profits. | Levied on goods and services purchased or consumed. |

| Who Pays It | Paid directly by the taxpayer (e.g., individual or company). | Paid indirectly by consumers via sellers or service providers. |

| Burden of Tax | Cannot be shifted — borne entirely by the taxpayer. | Can be shifted — passed on to the end consumer. |

| Collected By | Central or state government directly from taxpayers. | Businesses collect it and remit to the government. |

| Examples | Income Tax, Corporate Tax, Property Tax, Professional Tax. | GST, Customs Duty, Excise Duty, Service Tax. |

| Administered By | CBDT (Central Board of Direct Taxes). | CBIC (Central Board of Indirect Taxes and Customs). |

| Impact | Reduces disposable income but promotes equity. | Increases cost of goods/services but boosts government revenue. |

| Evasion Risk | Higher — relies on individual declarations and audits. | Lower — collected automatically during transactions. |

| Progressive or Regressive | Progressive — higher income means higher tax rate. | Regressive — affects all consumers equally, regardless of income. |

| Purpose | Redistribute wealth and promote fairness. | Encourage consumption-based revenue generation. |

3. Real-Life Example

Let’s make it simpler with two quick examples:

- Example 1 — Direct Tax:

Rohan earns ₹10 lakh annually. He files his income tax return (ITR) and pays ₹1.2 lakh as tax directly to the government. - Example 2 — Indirect Tax:

Rohan buys a new smartphone worth ₹20,000. The price already includes 18% GST — ₹3,600 — which the seller collects and sends to the government.

So while one tax is visible when you file returns, the other is silently built into the things you buy every day.

4. How Direct and Indirect Taxes Work Together

Types of taxes in India complement each other.

- Direct taxes promote fairness — ensuring those with higher incomes contribute more.

- Indirect taxes promote stability — generating steady revenue from mass consumption.

Together, they help maintain a sustainable tax system that funds everything from roads and healthcare to defense and education.

5. Which Type of Tax Is Better for the Economy?

There’s no simple winner — both serve unique purposes:

| Aspect | Direct Tax Advantage | Indirect Tax Advantage |

|---|---|---|

| Equity | Promotes fairness — rich pay more. | Same rate for all, easier to collect. |

| Ease of Administration | Requires complex monitoring and filing. | Simple, automatic collection. |

| Revenue Stability | May fluctuate with income levels. | Provides steady income through consumption. |

| Compliance | Encourages financial transparency. | Reduces evasion through automated systems. |

A healthy economy needs a balance of both — direct taxes to ensure fairness and indirect taxes to maintain revenue stability.

6. Key Takeaways

GST has simplified indirect taxes, while income tax reforms have made direct taxes more transparent.

Direct taxes = You pay the government directly.

Indirect taxes = You pay when you buy something.

Both are critical to India’s tax system and economic growth.

Once you understand the types of taxes in India, the next logical question is — how does the government actually collect them?

Types of taxes in India are a well-structured process designed to ensure fairness, accountability, and efficiency. Whether you’re a salaried employee, business owner, or consumer, every rupee you pay reaches the government through specific channels.

Let’s break down how both direct and indirect taxes are collected and managed.

1. Direct Tax Collection Process

Direct taxes — like income tax and corporate tax — are collected directly by the government through the Central Board of Direct Taxes (CBDT).

a. For Individuals (Income Tax)

There are three main ways individuals pay direct taxes in India:

- Tax Deducted at Source (TDS):

Employers or entities deduct a portion of income before paying you — this amount is directly deposited with the government.- Example: Your salary slip shows “TDS deducted” every month.

- Common in salaries, rent payments, interest on deposits, etc.

- Advance Tax:

If your total tax liability for the year exceeds ₹10,000, you’re required to pay taxes in advance — typically in four installments.- Helps the government maintain cash flow throughout the year.

- Self-Assessment Tax:

If there’s any balance due after accounting for TDS and advance tax, you pay it before filing your income tax return (ITR).

All these payments are made via the Income Tax Department’s online portal or authorized banks, ensuring a transparent digital trail.

b. For Companies (Corporate Tax)

Businesses and corporations pay taxes on their profits.

They use electronic systems to:

- File quarterly returns,

- Pay advance tax, and

- Undergo tax audits under the Income Tax Act.

Companies are also responsible for deducting TDS when paying salaries, vendor fees, or professional charges — making them both taxpayers and tax collectors.

2. Indirect Tax Collection Process

Indirect taxes — primarily GST (Goods and Services Tax) — are collected through a multi-stage process that ensures every transaction contributes to the revenue system.

The Central Board of Indirect Taxes and Customs (CBIC) oversees the collection and enforcement.

a. GST (Goods and Services Tax)

Under GST, the collection happens in a value chain model:

- Manufacturer → Distributor → Retailer → Consumer

Each link in this chain collects GST and passes it on to the next, ensuring tax credit at every stage. - The final consumer pays the full tax amount included in the price of goods or services.

- Businesses file monthly or quarterly GST returns through the GST portal.

This system reduces double taxation and ensures transparency in every transaction.

b. Customs Duty

Collected by customs authorities at airports, ports, and border checkpoints.

Applies to:

- Imports: Goods entering India.

- Exports: Certain goods leaving the country.

Customs duties help protect domestic industries and control the flow of foreign goods.

3. State-Level Tax Collection

While the central government handles major taxes, state governments collect their share to fund regional projects.

Examples of state-level taxes:

- Property Tax – collected by municipal bodies.

- Professional Tax – levied on salaried and self-employed individuals.

- Stamp Duty and Registration Charges – applied to real estate transactions.

- State GST (SGST) – collected by states as part of the GST framework.

This dual system — called cooperative federalism — ensures that both national and local administrations have adequate resources for development.

4. The Role of Digitalization in Tax Collection

India’s tax system has undergone a massive digital transformation in the past decade.

Key developments include:

- Online tax filing portals (Income Tax and GST).

- PAN–Aadhaar linkage for verification.

- Faceless assessment to reduce human interference and corruption.

- Digital payments for tax submission via UPI, net banking, or debit cards.

These innovations have made tax compliance simpler, faster, and more transparent, empowering citizens to fulfill their duties confidently.

5. Distribution of Collected Taxes

Once taxes are collected, they’re distributed between the Central and State Governments as per recommendations by the Finance Commission.

For instance:

- Income Tax and Corporate Tax → Central Government.

- GST → Shared equally between Centre and States.

- Property Tax and Stamp Duty → State and local governments.

Therefore, types of taxes in India present a balanced fiscal ecosystem where every level of government can function effectively.

6. Key Takeaways

- Direct taxes (like income tax) are collected directly from individuals and companies.

- Indirect taxes (like GST) are collected via goods and services.

- Digital tax collection has made compliance easier than ever.

- CBDT manages direct taxes; CBIC oversees indirect taxes.

- Tax revenue funds everything from national highways to healthcare programs.

- Tax revenue funds everything from national highways to healthcare programs.

Why Taxes Are Important for the Indian Economy

Have you ever wondered where your tax money actually goes? Or how your small contribution as a taxpayer can help transform an entire country?

Types of taxes in India aren’t just financial obligations — they’re the invisible threads that hold the Indian economy together. Every rupee collected helps fund the systems, services, and opportunities that shape our daily lives.

Whether you’re driving on a smooth highway, getting vaccinated at a government hospital, or studying in a public school — taxes are at work behind the scenes.

1. Taxes: The Lifeblood of Government Revenue

In any country, taxes are the primary source of government income.

For India, where over 1.4 billion people depend on public services, this revenue ensures that the government can run efficiently and meet national priorities.

Here’s how tax revenue supports the economy:

- Funds Development Projects: Roads, metros, railways, and digital infrastructure are built using tax money.

- Supports Welfare Programs: Schemes like Ayushman Bharat, PM Kisan, and MNREGA are sustained through tax contributions.

- Ensures National Security: Defense, police, and emergency response services rely heavily on government funding.

- Drives Innovation: Investments in renewable energy, technology, and research are powered by tax-funded budgets.

Without taxes, the government would have to rely on loans or external aid — making the country financially dependent.

2. Promoting Economic Growth and Stability

Taxes not only raise revenue but also shape the economic direction of the country.

Through strategic taxation, the government can:

- Encourage Investments: Offering tax benefits to startups, MSMEs, and green industries.

- Control Inflation: Adjusting tax rates on goods and services to manage prices.

- Redistribute Wealth: Progressive taxes ensure that higher earners contribute more, promoting economic equality.

- Strengthen GDP Growth: Higher tax compliance increases spending on infrastructure and social development, directly boosting GDP.

A balanced tax system creates a virtuous cycle — where citizens contribute, the government invests wisely, and the nation prospers collectively.

3. Empowering State and Local Governments

In types of taxes in India, tax collection and distribution are shared between the Central and State Governments.

This ensures that every state — whether large or small — receives adequate funding for its local needs such as:

- Building schools and hospitals,

- Maintaining roads and sanitation,

- Running local welfare programs.

State taxes like property tax, stamp duty, and professional tax give local authorities the power to make decisions that directly benefit their citizens.

Types of taxes in India makes governance more efficient and responsive.

4. Encouraging Responsible Citizenship

Types of taxes in India are not only a legal duty — it’s a moral responsibility. It represents our active participation in building the nation.

When citizens willingly pay taxes:

- It fosters trust and accountability between the people and the government.

- It creates a sense of ownership in national progress.

- It discourages corruption and underreporting.

In short, every honest taxpayer is a silent architect of India’s success story.

5. Supporting Social Equality

Types of taxes in India help narrow the gap between the rich and the poor through:

- Progressive taxation: Higher earners contribute more.

- Subsidies and welfare: The government redirects funds to uplift weaker sections.

- Public education and healthcare: Funded by taxes to ensure accessibility for all citizens.

Thus, the importance of types of taxes in India goes far beyond government funding — it’s about creating a balanced, fair, and inclusive economy.

6. Strengthening India’s Global Standing

A strong tax base not only helps internally but also improves India’s reputation globally.

When a nation demonstrates efficient tax collection and transparent financial management:

- Foreign investors gain confidence.

- Credit ratings improve.

- The rupee strengthens.

- Long-term growth becomes sustainable.

Types of taxes in India are, therefore, not just a national duty but also a strategic tool for economic diplomacy.

7. Key Takeaways

- Taxes fuel every aspect of India’s development — from defense to education.

- A strong tax system ensures fairness, equality, and economic growth.

- Tax compliance creates trust and accountability between citizens and government.

- Paying taxes is an investment in India’s future — and in your own.

As India grows into a global powerhouse, responsible taxpayers remain the backbone of that journey.

“Different Types of Taxes in India (Complete List with Examples)”

This section is structured to dominate SEO rankings for competitive keywords like types of taxes in India, types of direct tax, types of indirect tax, state taxes in India, GST, and income tax examples.

It’s designed for both professionals and laymen, combining clarity, visual tables, and real-world examples that make the topic engaging, practical, and memorable.

Different Types of Taxes in India (Complete List with Examples)

India’s tax system is broad, diverse, and carefully designed to ensure that every citizen and business contributes fairly to the nation’s development.

At its core, every tax in India falls into one of two categories — Direct Taxes and Indirect Taxes.

But within these two types are multiple sub-categories — each with its own purpose, collection process, and impact on the economy.

Let’s explore them one by one.

1. Direct Taxes in India

Direct taxes are levied on income, profit, or wealth and paid directly by individuals or entities to the government.

They are progressive in nature — meaning people with higher income pay a higher rate.

Here’s a full list of direct taxes currently (and historically) in India:

| Type of Direct Tax | Who Pays It | Levied On | Administered By | Example / Notes |

|---|---|---|---|---|

| Income Tax | Individuals, professionals, and firms | Annual income | Central Board of Direct Taxes (CBDT) | Paid through TDS, advance tax, or self-assessment tax. |

| Corporate Tax | Companies and corporations | Business profits | CBDT | Includes MAT (Minimum Alternate Tax) and DDT (Dividend Distribution Tax). |

| Capital Gains Tax | Individuals and companies | Profits from sale of assets like property or shares | CBDT | Divided into short-term and long-term capital gains. |

| Securities Transaction Tax (STT) | Investors and traders | Sale/purchase of securities on stock exchanges | CBDT | Deducted automatically during trades. |

| Property Tax | Property owners | Value of property | State/Municipal Authorities | Funds local development like roads and sanitation. |

| Professional Tax | Salaried employees, professionals | Income from employment or self-employment | State Governments | Maximum ₹2,500 per annum depending on state. |

| Wealth Tax (Abolished in 2015) | High-net-worth individuals | Net wealth | CBDT | Replaced by a surcharge on the super-rich. |

2. Indirect Taxes in India

Indirect taxes are applied on the sale, purchase, or consumption of goods and services.

They are collected by businesses from consumers and then remitted to the government — hence, the burden of payment is indirect.

The biggest reform in this category came with the introduction of GST (Goods and Services Tax) in 2017, which unified most indirect taxes under a single structure.

| Type of Indirect Tax | Who Pays It | Levied On | Administered By | Example / Notes |

|---|---|---|---|---|

| Goods and Services Tax (GST) | Consumers (via sellers) | Goods and services | CBIC | Includes CGST, SGST, and IGST components. |

| Customs Duty | Importers and exporters | Imported/exported goods | CBIC | Protects domestic industries; collected at ports and airports. |

| Excise Duty (Partially under GST) | Manufacturers | Manufactured goods | CBIC | Still applies to alcohol, tobacco, and petroleum. |

| Service Tax (Merged under GST) | Service providers | Services rendered | CBIC | Replaced by GST in 2017. |

| Value Added Tax (VAT) (State level) | Consumers | Sale of goods within a state | State Governments | Still levied on petroleum products in some states. |

| Entertainment Tax (Merged under GST) | Event organizers, OTTs, and cinemas | Entertainment services | State Governments | Now included under GST except for local bodies. |

3. State-Level Taxes in India

While most taxes are centrally administered, several important taxes are still collected by state or local governments.

| State Tax | Collected By | Applies To | Purpose |

|---|---|---|---|

| Stamp Duty and Registration Fee | State Governments | Property registration | Legal documentation and land ownership validation. |

| Property Tax | Local Municipal Bodies | Residential and commercial properties | Funds local civic amenities. |

| Road Tax | State Transport Departments | Vehicle registration and road use | Maintains state highways and roads. |

| Electricity Duty | State Governments | Electricity consumption | Funds energy infrastructure. |

| Professional Tax | State Governments | Salaried and self-employed professionals | Supports state-level welfare programs. |

4. Cess and Surcharges

In addition to regular taxes, the government also imposes cesses and surcharges for specific purposes.

| Type | Purpose | Example |

|---|---|---|

| Health and Education Cess | Fund public health and education programs | 4% on income tax amount |

| Krishi Kalyan Cess | Support agricultural development | Merged into GST framework |

| Infrastructure Cess | Improve transport infrastructure | Applied on vehicles and fuel |

| Swachh Bharat Cess | Promote sanitation and cleanliness | Now part of GST components |

5. The Big Picture: India’s Multi-Layered Tax Ecosystem

India’s tax system functions at three interconnected levels:

- Central Taxes — like Income Tax, Corporate Tax, and Customs.

- State Taxes — like Property Tax, Professional Tax, and Stamp Duty.

- Local Taxes — collected by municipal corporations for services like waste management or water supply.

Together, they form a coordinated revenue framework that sustains India’s rapid growth and welfare programs.

Conclusion:

Taxes are far more than just numbers on a government form — they are the foundation of India’s economic growth and social progress. Every road we drive on, every hospital that saves a life, and every school that shapes a child’s future is funded by the collective contributions of responsible taxpayers.

Understanding the different types of taxes in India — from income and corporate tax to GST and property tax — helps us see the bigger picture. These taxes aren’t random deductions; they’re carefully structured to ensure fairness, equity, and national development.

Leave a Reply