- Understanding the Rise of Artificial Intelligence in India

- List of the Best AI Stocks in India (2025 Edition)

- Detailed Review: Top AI Stocks in India to Watch in 2025

- 1. Tata Elxsi Ltd. — India’s AI Engineering Powerhouse

- 2. Persistent Systems Ltd. — The Machine Learning Multibagger

- 3. Bosch Ltd. — AI in Manufacturing and Smart Mobility

- 4. Infosys Ltd. — AI at Enterprise Scale

- 5. KPIT Technologies Ltd. — Powering Autonomous Vehicles

- 6. Affle India Ltd. — The AI AdTech Disruptor

- 7. Latent View Analytics Ltd. — The Data Science Gem

- Quick Recap Table: Best AI Stocks by Segment

- Top AI Stocks in India with Low Price (2025 Edition)

- 1. Zensar Technologies Ltd. — The Digital Transformation Specialist

- 2. Latent View Analytics Ltd. — Small-Cap AI Powerhouse

- 3. Happiest Minds Technologies Ltd. — The Emerging AI Innovator

- 4. Saksoft Ltd. — The Affordable AI Digital Transformer

- 5. Affle India Ltd. — The AI AdTech Growth Engine

- 💰 Bonus Picks: Low-Price AI Stocks to Watch in 2025

- 📊 Why Low-Priced AI Stocks Are Attractive in 2025

- Future of AI Stocks in India: 2025 and Beyond

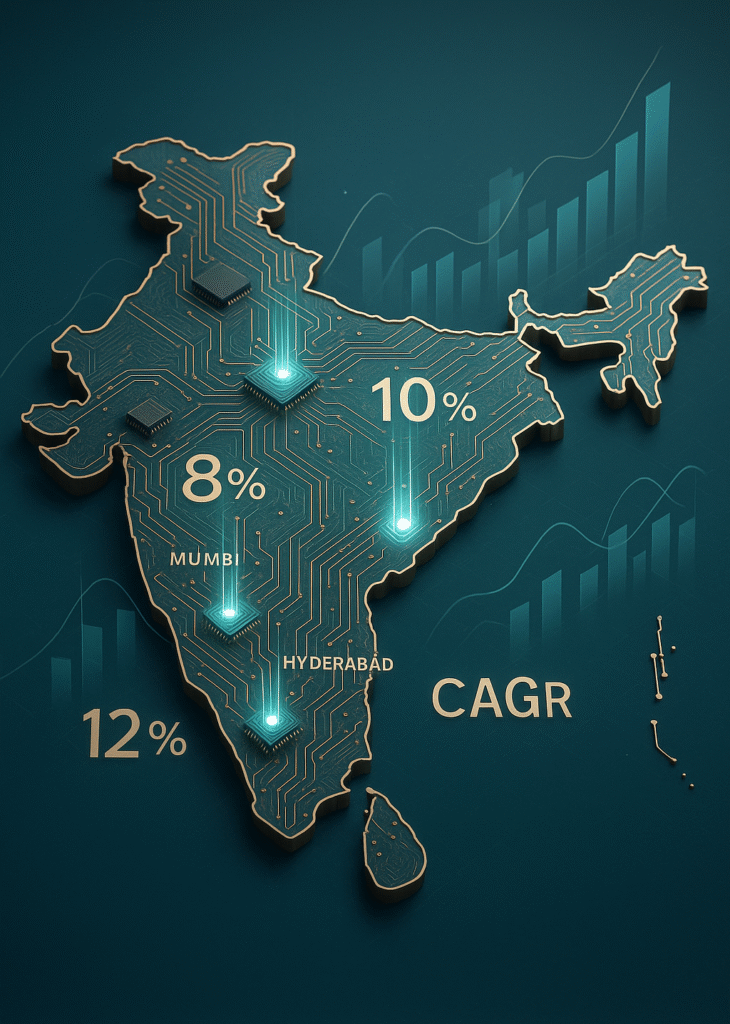

- 1. Market Growth Forecast: India’s AI Opportunity by 2030

- 2. AI-Driven Disruption Across Key Industries

- 3. Government Support and Policy Boost

- 4. Emerging Trends Reshaping AI Stocks in India

- 5. Expert Opinions: Is Now the Right Time to Invest in AI Stocks in India?

- 6. Long-Term Outlook: 2030 and Beyond

- 🔮 Key Takeaway

- Frequently Asked Questions (FAQs) About AI Stocks in India

- 1. Which are the best AI stocks to buy in India right now?

- 2. Which AI stocks in India are best for long-term investment?

- 3. Are AI penny stocks worth investing in India?

- 4. How to invest in AI stocks in India as a beginner?

- 5. Is AI stock trading safe in India?

- 6. What are the upcoming AI IPOs and future investment opportunities in India?

- 7. Which is the best AI stock under ₹500 in India?

- Conclusion: The Future Belongs to AI — and So Do the Returns

Artificial Intelligence (AI) isn’t just a buzzword anymore — it’s the engine driving India’s next technological revolution. From financial services and healthcare to logistics and entertainment, AI adoption across Indian industries is accelerating faster than ever, transforming how companies operate and compete.

And behind this digital wave lies an incredible investment opportunity — AI stocks in India. These companies aren’t just integrating machine learning and automation into their processes; they’re building the very backbone of India’s AI-driven future.

Whether you’re a seasoned investor eyeing long-term potential or a beginner exploring emerging tech sectors, understanding where to invest in India’s AI ecosystem could be one of the smartest financial moves of 2025.

Understanding the Rise of Artificial Intelligence in India

Artificial Intelligence is no longer confined to futuristic movies or Silicon Valley labs — it’s rapidly becoming the heart of India’s technological evolution. Over the past few years, the AI stocks in India have witnessed extraordinary growth, reshaping business models and driving a new era of innovation across sectors.

India’s AI Market at a Glance

India is currently one of the fastest-growing AI markets globally.

According to NASSCOM, the AI stocks in India were valued at around $7.8 billion in 2024, and it’s projected to grow to over $17 billion by 2027, reflecting a CAGR of nearly 30–35%.

This surge is being powered by:

- The government’s Digital India and Make in India initiatives

- The rise of AI-driven start-ups and unicorns

- Increased demand for AI-based automation and analytics across industries

- Heavy investments from global technology giants establishing AI research hubs in India

Why Artificial Intelligence Matters for Investors

For investors, the AI stocks in India present a once-in-a-decade opportunity. As companies across IT, finance, healthcare, logistics, and even manufacturing embrace AI to enhance productivity and decision-making, AI stocks in India are positioned for massive long-term growth.

Here’s why investors are paying close attention:

- AI adoption is mainstream. Over 75% of Indian enterprises are now experimenting with AI-based solutions in their operations.

- High return potential. AI companies often show consistent revenue growth and high profit margins due to scalable digital solutions.

- Cross-sector presence. From AI-driven fintech to machine learning in healthcare, AI is creating new revenue streams across verticals.

- Global competitiveness. Indian AI firms are increasingly serving global clients, giving them both domestic stability and international exposure.

Government Push and Policy Support

The Indian government has also recognized the importance of AI in shaping the future economy. Through the National AI Mission and partnerships with NITI Aayog, initiatives are underway to promote AI research, data sharing, and skill development.

Additionally:

- AI-based startups receive favorable tax benefits and grants under Startup India.

- AI skill programs like “Responsible AI for Youth” are training the next generation of data scientists.

- Policies supporting AI in healthcare, agriculture, and urban governance are expanding its real-world applications.

All of this creates a strong foundation for AI stocks in India to scale, innovate, and deliver long-term shareholder value — making AI stocks in India a strategic addition to any modern investment portfolio.

A Perfect Storm of Innovation and Investment

With both the public sector and private industry pushing AI adoption, India is poised to become a global AI powerhouse.

The country’s unique blend of tech talent, startup culture, and cost efficiency gives Indian AI firms an edge that few other nations can match.

As we move further into 2025, the AI stocks in India will not just be a driver of digital transformation — it will be one of the core engines of economic growth and market returns.

Market Overview: India’s AI Boom and Investment Potential

The AI stocks in India are more than a passing trend — it’s the foundation of a long-term economic transformation. Over the past decade, AI has evolved from a niche technology into a mainstream business necessity, powering everything from customer service chatbots to advanced data analytics and robotics.

According to a joint report by Deloitte and NASSCOM, India’s AI market is expected to surpass $17 billion by 2027, while the country’s overall AI-led economy could add nearly $1 trillion to GDP by 2035. These numbers highlight one thing: AI investments in India are no longer optional — they’re essential.

AI’s Growing Footprint Across Sectors

AI adoption in India is accelerating across multiple sectors:

| Sector | AI Applications | Market Impact |

|---|---|---|

| Information Technology | Cloud-based AI, automation, predictive analytics | Enhances productivity, reduces operational costs |

| Banking & Finance | Fraud detection, algorithmic trading, credit scoring | Improves accuracy and customer experience |

| Healthcare | Diagnostics, drug discovery, medical imaging | Enhances efficiency and patient outcomes |

| Manufacturing | Robotics, AI-driven automation, predictive maintenance | Reduces downtime and improves quality |

| E-commerce & Retail | Recommendation systems, AI-driven marketing | Boosts sales conversion and customer retention |

This wide-scale integration shows how AI stocks in India are increasingly diversified — offering investors opportunities across technology, manufacturing, finance, and healthcare.

Foreign and Domestic Investments Fueling Growth

Global giants like Google, Amazon, and Microsoft have established AI research centers in India, recognizing the country’s massive talent pool.

Simultaneously, Indian IT heavyweights such as Infosys, Wipro, TCS, and Tech Mahindra are investing heavily in AI R&D to maintain competitiveness.

In fact:

- The Indian AI startup ecosystem has grown over 14x in the last six years, with over 5,000 AI-related startups registered by 2025.

- Venture capital funding in AI and automation reached nearly $5 billion in 2024, up 60% from the previous year.

- The AI automation and robotics segment alone has attracted institutional investors eyeing high-growth opportunities.

These trends underline why the AI stocks in India are increasingly becoming a magnet for both domestic investors and foreign institutional capital.

AI Stocks: The Next Frontier of Smart Investing

For investors, this booming ecosystem offers two powerful advantages:

- Diversification – AI cuts across multiple sectors, allowing investors to spread risk effectively.

- Future-Proofing – Companies leveraging AI will likely outperform peers that lag behind in automation and analytics.

Moreover, AI stocks in India tend to demonstrate consistent profit margins, higher innovation cycles, and lower human capital dependency — all attractive traits for long-term investment.

With India now emerging as a global hub for AI innovation, early investors in AI stocks in India stand to benefit from exponential growth as these technologies mature and scale across industries.

Up next, we’ll zoom in on the specific factors driving this expansion of AI stocks in India in— including innovation, digital infrastructure, and government support — in the next section:

AI Sector Growth Drivers in India

The explosive rise of AI stocks in India isn’t a coincidence — it’s the result of strategic alignment between innovation, infrastructure, and investment. AI stocks in India are thriving because several powerful growth drivers are simultaneously shaping a fertile ecosystem for technology and business expansion.

Let’s look at the key forces pushing this revolution forward.

1. Government-Led Digital Transformation

The Indian government has been a major catalyst behind the AI revolution. Initiatives like Digital India, Startup India, and the National Strategy for Artificial Intelligence have created a favorable environment for innovation and AI research.

- NITI Aayog’s AI Mission focuses on leveraging AI for healthcare, agriculture, education, smart cities, and mobility.

- AI Centers of Excellence (CoEs) have been launched in major cities to foster R&D and collaboration.

- Public sector programs now actively use AI for predictive governance, citizen services, and data analytics.

This strong government backing sends a clear signal: AI is central to India’s economic and technological future.

2. Rising AI Adoption Among Indian Enterprises

Large corporations and emerging startups alike are embracing AI to gain a competitive edge.

According to a 2024 Deloitte report, over 75% of Indian enterprises have already adopted or plan to adopt AI-based automation, analytics, and cloud services.

- IT giants like TCS, Infosys, and Wipro are integrating AI into core service offerings.

- Manufacturing leaders such as Bosch and L&T are deploying AI automation systems for predictive maintenance and robotics.

- Fintech firms like Paytm and Razorpay use machine learning for fraud detection and risk modeling.

This enterprise-wide adoption translates directly into revenue growth and market expansion, making AI stocks in India one of the most promising categories on Indian exchanges.

3. Expanding AI Startup Ecosystem

India’s AI startup landscape is one of the fastest-growing in the world. With over 5,000 AI-related startups as of 2025, India now ranks among the top five global hubs for AI innovation.

These startups are not only building next-gen products in automation, NLP, and computer vision — they are also driving job creation and attracting foreign investment.

Examples include:

- Arya.ai – pioneering autonomous systems.

- Mad Street Den – powering computer vision and retail intelligence.

- Qure.ai – applying AI in healthcare diagnostics.

- Yellow.ai – redefining conversational automation.

The result is a robust ecosystem where AI stocks in India contribute directly to both the domestic economy and global supply chains.

4. Surge in AI Education and Workforce Readiness

Another crucial growth driver for AI stocks in India is India’s rapidly expanding AI-skilled workforce.

Educational institutions and edtech firms like Simplilearn, Great Learning, and Coursera India are producing thousands of AI and ML-certified professionals every year.

This abundance of affordable, skilled talent strengthens India’s position as a global AI development hub, helping both startups and listed companies scale efficiently.

5. Increasing Institutional and Global Investment

Foreign institutional investors (FIIs) and domestic mutual funds are beginning to recognize the long-term profitability of AI-driven firms.

Venture capital funding in Indian AI startups surpassed $5 billion in 2024, while leading mutual funds now include AI automation and tech stocks in thematic portfolios.

Moreover, the launch of AI-focused ETFs and AI stocks in India provides new avenues for small investors to participate in this tech revolution.

Together, these drivers have created the perfect storm of opportunity. From cutting-edge R&D and digital infrastructure to supportive policy and investor enthusiasm, India’s AI sector is no longer emerging — it’s accelerating.

And for investors, this means one thing: the next generation of multibagger AI stocks in India could already be trading on the market today.

List of the Best AI Stocks in India (2025 Edition)

The Indian stock market has seen an incredible surge in AI-driven companies that are not only transforming industries but also delivering impressive returns to investors. Whether you’re looking for blue-chip AI shares, affordable AI penny stocks, or long-term investment opportunities, the options in India are expanding rapidly.

Below is a curated list of the top-performing and most promising AI stocks in India for 2025, carefully selected based on factors like AI integration, financial stability, innovation capacity, and market potential.

🏆 Top 15 AI Stocks in India for 2025

| Rank | Company Name | Sector / Focus Area | AI Application | Market Cap (₹ Cr) | Stock Price (₹) |

|---|---|---|---|---|---|

| 1 | Tata Elxsi Ltd. | Technology & Engineering | AI in automotive and design automation | 60,000+ | ~8,000 |

| 2 | Persistent Systems Ltd. | IT Services | Machine learning & cloud automation | 55,000+ | ~7,500 |

| 3 | Bosch Ltd. | Manufacturing | AI in industrial automation & smart factories | 50,000+ | ~25,000 |

| 4 | Affle India Ltd. | AdTech | AI-driven digital marketing & data analytics | 15,000+ | ~1,300 |

| 5 | Zensar Technologies Ltd. | IT & Cloud Solutions | AI for enterprise automation | 10,000+ | ~600 |

| 6 | Happiest Minds Technologies Ltd. | Digital Transformation | AI & ML for analytics and cloud integration | 17,000+ | ~900 |

| 7 | Infosys Ltd. | IT & Consulting | AI-powered automation (Infosys Cobalt & Topaz) | 600,000+ | ~1,600 |

| 8 | Tech Mahindra Ltd. | IT & Telecom | AI in network optimization and customer analytics | 140,000+ | ~1,200 |

| 9 | Tata Consultancy Services (TCS) | IT & AI Research | AI-enabled business automation | 1,300,000+ | ~3,900 |

| 10 | Wipro Ltd. | IT & Cloud Solutions | AI integration and digital automation | 250,000+ | ~550 |

| 11 | KPIT Technologies Ltd. | Automotive Tech | AI in autonomous vehicles & embedded software | 30,000+ | ~2,200 |

| 12 | Latent View Analytics Ltd. | Data Analytics | AI-based insights & predictive analytics | 12,000+ | ~500 |

| 13 | Oracle Financial Services Software Ltd. | FinTech | AI in banking & risk assessment | 45,000+ | ~3,200 |

| 14 | Coforge Ltd. | IT Services | AI-driven automation & digital operations | 55,000+ | ~6,000 |

| 15 | Saksoft Ltd. | Data & Cloud Solutions | AI for digital transformation | 2,000+ | ~300 |

💡 Note: Stock prices and market caps are indicative and may vary. Always check the latest market data before investing.

💹 Why These AI Stocks Are Worth Watching in 2025

- Diverse Sector Exposure: These companies represent a mix of IT, manufacturing, fintech, and analytics, giving investors balanced exposure to India’s AI revolution.

- Strong Innovation Track Record: Each of these companies invests heavily in R&D, AI frameworks, and automation, ensuring long-term competitiveness.

- Global AI Integration: Firms like TCS, Infosys, and Persistent Systems are exporting AI-based solutions globally, generating consistent foreign revenue inflows.

- Financial Resilience: Most of these firms maintain healthy balance sheets, low debt levels, and steady dividend yields, ensuring stability alongside growth.

- Emerging Players with Explosive Potential: Companies such as Affle India, Latent View Analytics, and Saksoft represent mid-cap growth opportunities that could scale rapidly in the coming years.

📈 Category Breakdown: Matching Investor Goals

Top 5 AI Stocks in India for Long-Term Investment

For investors looking at consistent compounding over years, these AI-driven giants are ideal:

- Tata Elxsi Ltd.

- Persistent Systems Ltd.

- Infosys Ltd.

- Bosch Ltd.

- KPIT Technologies Ltd.

These companies have proven earnings growth, strong AI infrastructure, and a clear innovation roadmap for the next decade.

Top 5 Low-Price AI Stocks in India for Small Investors

If you’re starting out or prefer AI stocks in India under ₹1000, consider:

- Zensar Technologies

- Latent View Analytics

- Saksoft Ltd.

- Happiest Minds Technologies

- Affle India Ltd.

These stocks offer affordable entry points without compromising exposure to the fast-growing AI sector.

Top 5 AI Stocks with High Growth Potential

For aggressive investors eyeing high returns:

- Persistent Systems Ltd.

- KPIT Technologies Ltd.

- Zensar Technologies Ltd.

- Latent View Analytics Ltd.

- Affle India Ltd.

They combine AI innovation, export potential, and scalability — making them strong multibagger candidates.

🔍 Key Investment Insight

The AI stocks in India are still at an early stage, which means valuations may fluctuate — but the long-term opportunity is undeniable.

As AI becomes deeply embedded in every business process, companies with early AI adoption will likely enjoy exponential revenue growth and sustained market leadership.

📊 Pro Tip: Diversify across at least 3–5 AI sector stocks — including a mix of blue-chip and mid-cap companies — to balance risk and maximize returns.

Detailed Review: Top AI Stocks in India to Watch in 2025

India’s AI landscape is flourishing with companies integrating machine learning, data analytics, and automation into their business models. Below is a detailed look at some of the most influential AI-driven companies shaping the country’s digital future — and why they deserve a place in your investment portfolio.

1. Tata Elxsi Ltd. — India’s AI Engineering Powerhouse

Tata Elxsi is one of the top AI stocks in India, renowned for its cutting-edge innovation in automotive, healthcare, and entertainment technologies.

🔹 AI Focus Areas

- Autonomous Vehicles: Partnered with global automakers to develop AI-driven self-parking, driver assistance, and autonomous navigation systems.

- Healthcare Analytics: Uses AI to enhance patient diagnostics, medical imaging, and device integration.

- Media & Entertainment: Employs AI in content recommendation and digital design automation.

🔹 Investment Highlights

- 5-year CAGR: ~27%

- Consistent revenue growth through AI-based service exports

- Strong R&D investments backed by the Tata Group

🔹 Why It Stands Out

Tata Elxsi is a pioneer in AI-based engineering with global recognition, and its diversified AI portfolio ensures long-term sustainability.

2. Persistent Systems Ltd. — The Machine Learning Multibagger

Persistent Systems has positioned itself as a leader in AI and cloud automation and is one of the top AI stocks in India, helping global enterprises transform digitally.

🔹 AI Focus Areas

- Cloud AI Platforms: Integration with Google Cloud and AWS AI frameworks.

- Data Automation: Machine learning for enterprise-level data analytics.

- Healthcare & BFSI AI Applications: Smart solutions for hospitals and banks.

🔹 Investment Highlights

- Revenue crossed ₹10,000 Cr in FY 2024.

- Partnered with IBM Watson and Microsoft Azure AI for enterprise AI delivery.

- High client retention and international exposure.

🔹 Why It Stands Out

Persistent is one of the most agile Indian AI companies, benefiting from the global demand for AI-led digital transformation.

3. Bosch Ltd. — AI in Manufacturing and Smart Mobility

Bosch has evolved into a global AI innovation leader, especially in industrial automation, robotics, and automotive intelligence.

🔹 AI Focus Areas

- Smart Factory Automation: AI-driven predictive maintenance systems.

- Mobility AI: Advanced driver assistance and traffic prediction models.

- Industrial Robotics: Machine learning-powered control systems.

🔹 Investment Highlights

- Bosch India AI Center established in Bengaluru.

- Major contracts in Industry 4.0 automation and EV infrastructure.

- Consistent dividend payer and stable stock growth.

🔹 Why It Stands Out

Bosch combines AI expertise with manufacturing excellence, offering exposure to both industrial AI and mobility innovation — a rare combination for investors.

4. Infosys Ltd. — AI at Enterprise Scale

As one of India’s largest IT powerhouses, Infosys has fully embraced AI through its Infosys Topaz and Cobalt initiatives, helping global clients automate and optimize their digital ecosystems.

🔹 AI Focus Areas

- AI in Cloud Computing: Intelligent infrastructure management.

- AI for Software Development: Code generation and predictive analytics.

- Enterprise Automation: End-to-end process automation across industries.

🔹 Investment Highlights

- One of India’s most stable AI stocks with strong global exposure.

- Over 40% of its services now AI-enhanced.

- Actively investing in AI upskilling for 200,000+ employees.

🔹 Why It Stands Out

Infosys combines financial stability with deep AI expertise, making it one of the safest yet most promising AI investments in India.

5. KPIT Technologies Ltd. — Powering Autonomous Vehicles

KPIT Technologies specializes in AI-driven automotive engineering, focusing on electric mobility, autonomous driving, and embedded AI systems.

🔹 AI Focus Areas

- AI for autonomous vehicle systems.

- Advanced driver-assistance systems (ADAS).

- Smart vehicle communication and diagnostics.

🔹 Investment Highlights

- Key partnerships with global automakers like BMW and Renault.

- Revenue growth of over 25% YoY (2024).

- Dominant player in AI for automotive technology.

🔹 Why It Stands Out

As India transitions to EVs and smart cars, KPIT sits at the crossroads of AI innovation and mobility, making it a future-ready stock with enormous upside potential.

6. Affle India Ltd. — The AI AdTech Disruptor

Affle India is transforming the digital marketing landscape with AI-powered advertising and consumer intelligence.

🔹 AI Focus Areas

- Predictive Consumer Analytics: Behavior-based ad personalization.

- Ad Fraud Detection: Real-time ML-driven validation systems.

- Omnichannel Marketing: AI optimization across web and mobile.

🔹 Investment Highlights

- Rapid profit growth (25%+ CAGR over 5 years).

- Expanding globally across Southeast Asia and Africa.

- Low-debt, high-margin business model.

🔹 Why It Stands Out

Affle’s AI-centric business model offers direct exposure to India’s booming digital economy and online advertising markets.

7. Latent View Analytics Ltd. — The Data Science Gem

Latent View is one of India’s few pure-play AI analytics firms, serving clients in finance, retail, and consumer goods.

🔹 AI Focus Areas

- Predictive analytics and AI-based insights.

- Customer segmentation and risk modeling.

- Cloud-based AI data solutions.

🔹 Investment Highlights

- Serves Fortune 500 clients globally.

- Impressive profit margins (~25%).

- Low debt, consistent cash flow, and growing client base.

🔹 Why It Stands Out

Latent View’s deep specialization in data intelligence and predictive analytics makes it one of the best small-cap AI stocks in India for long-term investors.

Quick Recap Table: Best AI Stocks by Segment

| Category | Top Picks |

|---|---|

| Blue-Chip AI Stocks | Infosys, TCS, Tech Mahindra |

| Mid-Cap Growth AI Stocks | Persistent Systems, Tata Elxsi, KPIT |

| AI Penny / Low-Price Stocks | Latent View Analytics, Zensar Tech, Saksoft |

| AI Manufacturing / Robotics | Bosch Ltd., L&T Tech Services |

| AI Digital & AdTech | Affle India Ltd., Happiest Minds |

Top AI Stocks in India with Low Price (2025 Edition)

Not every investor can start with premium blue-chip stocks — and that’s perfectly fine. The Indian market offers several AI stocks in India with prices under ₹1000 (and even ₹500) that combine affordability, innovation, and long-term potential.

These are hidden gems often overlooked by big institutional investors but capable of delivering multibagger returns as India’s AI revolution accelerates.

1. Zensar Technologies Ltd. — The Digital Transformation Specialist

Stock Price: ~₹600

Market Cap: ₹10,000+ Cr

Zensar Technologies is a mid-cap IT company offering AI-driven enterprise solutions, digital transformation, and automation.

🔹 AI Strengths

- Deploys AI to automate IT processes and optimize business operations.

- Partnered with global tech leaders like AWS and Salesforce to enhance AI-driven cloud services.

- Strong digital transformation contracts across BFSI, retail, and manufacturing sectors.

🔹 Investment Outlook

Zensar’s low debt, steady growth, and AI adoption make it an excellent entry-level AI stock for investors seeking value with future scalability.

2. Latent View Analytics Ltd. — Small-Cap AI Powerhouse

Stock Price: ~₹500

Market Cap: ₹12,000+ Cr

A pure-play AI analytics firm, Latent View specializes in data science, predictive analytics, and AI consulting.

🔹 AI Strengths

- Deep domain expertise in machine learning and big data modeling.

- Works with Fortune 500 clients in finance, retail, and consumer analytics.

- High profit margins and strong client retention.

🔹 Investment Outlook

Its niche AI positioning and export-driven business make Latent View a strong candidate for long-term compounding.

3. Happiest Minds Technologies Ltd. — The Emerging AI Innovator

Stock Price: ~₹900

Market Cap: ₹17,000+ Cr

Happiest Minds focuses on AI, cloud, and IoT integration, serving global digital-first enterprises.

🔹 AI Strengths

- Provides AI-based automation, NLP, and cognitive analytics.

- Partnered with Microsoft Azure AI for scalable business solutions.

- Focus on cybersecurity and cloud-native AI applications.

🔹 Investment Outlook

With consistent revenue growth and an expanding international presence, Happiest Minds is one of the most promising mid-cap AI stocks in India under ₹1000.

4. Saksoft Ltd. — The Affordable AI Digital Transformer

Stock Price: ~₹300

Market Cap: ₹2,000+ Cr

Saksoft is a smaller but rapidly growing player offering AI-based digital transformation and data analytics solutions for enterprises worldwide.

🔹 AI Strengths

- Provides end-to-end AI consulting for data-driven business transformation.

- Focused on AI-driven cloud migration, automation, and data security.

- Expanding presence in Europe and North America.

🔹 Investment Outlook

A low-cost entry into the AI sector, Saksoft’s consistent earnings and scalable service model make it a strong contender for AI penny stock investors.

5. Affle India Ltd. — The AI AdTech Growth Engine

Stock Price: ~₹1,300

Market Cap: ₹15,000+ Cr

While slightly above the ₹1000 threshold, Affle India earns a place for its AI-first business model and high compounding potential.

🔹 AI Strengths

- Uses machine learning for ad personalization, consumer engagement, and fraud detection.

- Strong global footprint with steady profit growth.

- A leader in AI advertising intelligence.

🔹 Investment Outlook

Affle India offers exposure to the fastest-growing AI segment — digital marketing, where data and automation are the new currency.

💰 Bonus Picks: Low-Price AI Stocks to Watch in 2025

| Company | Current Price (₹) | AI Focus Area |

|---|---|---|

| Sonata Software Ltd. | ~₹700 | AI-based IT modernization |

| eClerx Services Ltd. | ~₹1,900 | AI-driven data operations |

| Tata Communications Ltd. | ~₹1,800 | AI in digital infrastructure |

| Newgen Software | ~₹750 | AI in enterprise content automation |

| Cigniti Technologies | ~₹1,400 | AI-powered software testing |

💡 Pro Tip: Always verify recent prices and financials before investing. Low-priced stocks can experience high volatility, so focus on fundamentally strong companies with clear AI integration.

📊 Why Low-Priced AI Stocks Are Attractive in 2025

- Entry-Level Accessibility: Perfect for new investors looking to explore the AI space without large capital.

- Faster Growth Trajectory: Small and mid-cap firms can grow revenues faster than large enterprises.

- Acquisition Potential: Many low-cap AI firms may attract mergers or partnerships with global tech giants.

- Thematic Relevance: AI and automation remain top investment themes in India for 2025–2030.

In essence, these AI stocks in India under ₹1000 aren’t just affordable — they’re positioned to ride the next big wave of AI adoption, automation, and digital expansion across the Indian economy.

Future of AI Stocks in India: 2025 and Beyond

Artificial intelligence isn’t just another sector — it’s the engine driving India’s next decade of economic growth. As businesses, governments, and consumers embrace automation, data analytics, and digital intelligence, AI stocks in India are entering their most transformative phase yet.

Here’s a deep look into where the AI sector — and your investments — are heading.

1. Market Growth Forecast: India’s AI Opportunity by 2030

According to a joint report by NASSCOM and McKinsey, the Indian AI market is projected to grow from $7.8 billion in 2024 to over $25 billion by 2030.

That’s a compound annual growth rate (CAGR) of 23%, driven by rapid adoption across healthcare, banking, logistics, and manufacturing.

📊 Key Forecast Highlights

- By 2027, AI-led productivity improvements could add $450–500 billion to India’s GDP.

- AI exports from Indian IT firms are expected to cross $10 billion annually.

- The AI workforce in India will exceed 1 million professionals by 2030.

These statistics indicate one clear message: AI will be the backbone of India’s digital economy, and the AI stocks leading this revolution will see exponential gains.

2. AI-Driven Disruption Across Key Industries

AI’s influence isn’t limited to tech companies — it’s reshaping nearly every industry in India.

| Industry | AI Application | Investment Impact |

|---|---|---|

| Banking & Finance | AI for risk modeling, credit scoring, fraud detection | Boosts efficiency, cuts losses |

| Healthcare | Diagnostics, imaging, drug discovery | Drives innovation and new business models |

| Manufacturing | Robotics, process automation, predictive maintenance | Enhances productivity |

| Retail & E-commerce | Personalization, inventory AI | Increases revenue and customer satisfaction |

| Energy & Utilities | AI-based demand forecasting | Improves sustainability and cost control |

These sectors are fueling demand for AI services, creating more revenue streams for companies like Tata Elxsi, Wipro, KPIT, and Persistent Systems.

3. Government Support and Policy Boost

India’s proactive approach to AI governance and development is one of the biggest tailwinds for investors.

🔹 Key Initiatives:

- National AI Mission (NITI Aayog): Focused on healthcare, education, and smart cities.

- Digital India 2.0: Aims to integrate AI into government services and public infrastructure.

- AI Centers of Excellence: Funded by MeitY and DST to boost innovation and research.

- AI Skilling Programs: Government and edtech firms are jointly training professionals in AI and machine learning.

The result? A thriving ecosystem that promotes innovation, accelerates adoption, and increases investor confidence.

4. Emerging Trends Reshaping AI Stocks in India

Here are five major trends that will define the next phase of AI stocks in India:

- Generative AI Goes Mainstream – Indian IT firms are integrating GenAI tools to automate code generation, marketing, and customer support.

- AI-Powered FinTech Expansion – Digital banks and NBFCs are adopting AI for personalized finance solutions.

- AI-Driven ESG & Sustainability – AI is being used to track carbon footprints and optimize energy usage.

- AI Chips & Hardware Growth – Companies investing in AI chip manufacturing could emerge as new multibaggers.

- AI Mergers and Acquisitions – Expect global tech giants to acquire promising Indian AI startups in 2025–2027.

Together, these shifts indicate a multi-layered growth cycle where both established tech giants and upcoming AI innovators can thrive.

5. Expert Opinions: Is Now the Right Time to Invest in AI Stocks in India?

Most market analysts agree that the AI wave is still in its early stages — making 2025 an ideal entry point for long-term investors.

🧠 Analyst Insights:

- Motilal Oswal Research predicts that AI-related revenue for top IT firms could double by 2027.

- ICICI Direct sees AI-based automation companies growing earnings by 20–25% annually.

- Morgan Stanley labels India as a “key global hub for AI talent and scalable solutions,” predicting strong stock performance in the sector.

In short, the fundamentals, policy environment, and innovation pipeline all point to massive upside potential for AI-focused Indian companies.

6. Long-Term Outlook: 2030 and Beyond

By 2030, AI is expected to be as critical to business as electricity — seamlessly integrated into every process, product, and decision.

Indian companies that invest early in AI infrastructure and R&D will not only dominate locally but also export AI solutions globally, capturing a significant share of the international market.

For investors, this means:

- The AI sector could become the next IT boom, similar to what software exports did for India in the 2000s.

- AI ETFs and mutual funds will offer diversified, theme-based investment options.

- AI penny stocks from 2025 could become mid-caps by 2030, delivering multi-fold returns.

The future of AI stocks in India is therefore not just bright — it’s transformational.

🔮 Key Takeaway

If you missed India’s IT boom in the early 2000s, AI offers a second chance to ride a once-in-a-generation wave of innovation.

With government backing, private investment, and strong market momentum, AI stocks in India are poised to deliver long-term wealth creation for those who start early.

Frequently Asked Questions (FAQs) About AI Stocks in India

1. Which are the best AI stocks to buy in India right now?

Some of the best AI stocks in India for 2025 include:

- Tata Elxsi Ltd. – AI for automotive and engineering design.

- Persistent Systems Ltd. – Cloud AI and digital automation leader.

- Infosys Ltd. – AI in enterprise solutions and process automation.

- KPIT Technologies Ltd. – AI for autonomous vehicles.

- Bosch Ltd. – AI in industrial automation and smart mobility.

These companies have strong fundamentals, consistent growth, and AI-driven revenue streams, making them ideal for medium- to long-term investors.

2. Which AI stocks in India are best for long-term investment?

For long-term investors, focus on companies with strong R&D, recurring global clients, and sustainable business models:

- Tata Elxsi

- Persistent Systems

- KPIT Technologies

- Happiest Minds Technologies

- Infosys

They have the financial strength and innovation capacity to ride the AI wave for the next decade.

3. Are AI penny stocks worth investing in India?

AI stocks in India — such as Saksoft Ltd. and Latent View Analytics Ltd. — can offer high potential returns, but they also carry higher volatility and risk.

If you’re a beginner, limit exposure to less than 10% of your portfolio and always research the company’s balance sheet, growth plans, and AI involvement before investing.

4. How to invest in AI stocks in India as a beginner?

Here’s a simple step-by-step guide to invest in AI stocks in India:

- Open a Demat Account – with trusted brokers like Zerodha, Groww, or Upstox.

- Research Stocks – use platforms like Moneycontrol or Screener.in.

- Diversify Investments – mix blue-chip, mid-cap, and small-cap AI stocks.

- Track Performance Regularly – monitor AI sector trends and quarterly results.

- Stay Long-Term Focused – avoid short-term speculation; AI is a marathon, not a sprint.

💡 Pro Tip: Beginners can also consider AI-themed ETFs or mutual funds for diversification and lower risk exposure.

5. Is AI stock trading safe in India?

Yes, AI stocks in India are safe to trade, provided you focus on fundamentally strong companies listed on NSE and BSE.

Avoid speculative penny stocks without proven AI products or financial backing.

AI is a high-growth but long-horizon sector, so patience is key for optimal returns.

6. What are the upcoming AI IPOs and future investment opportunities in India?

India’s startup ecosystem is buzzing with AI-driven companies preparing for IPOs in the next few years.

Keep an eye on:

- AI and data analytics startups in fintech and healthcare.

- AI automation and robotics firms tied to smart manufacturing.

- AI SaaS and cloud intelligence platforms that may list by 2026–2027.

As AI adoption accelerates, these IPOs could become the next big investment frontier for early investors.

7. Which is the best AI stock under ₹500 in India?

As of 2025, Latent View Analytics Ltd. is one of the best AI stocks in India under ₹500 , thanks to its pure AI-driven business model, strong client base, and rapid scalability.

It’s considered a high-potential small-cap stock for investors seeking exposure to AI and data science.

Conclusion: The Future Belongs to AI — and So Do the Returns

Artificial Intelligence is not just reshaping industries — it’s redefining how India invests.

From autonomous cars to predictive analytics and smart automation, AI stocks in India represent the new era of innovation-led wealth creation.

Investors who recognize this trend early stand to benefit from massive long-term value, just as those who invested in IT during the 2000s did.

Whether you choose blue-chip AI leaders like Infosys and TCS, or emerging disruptors like Latent View and Happiest Minds, remember this —

“The best time to invest in the future is before everyone else realizes it’s here.”

So, start small, stay consistent, and let India’s AI revolution work in your favor.

Leave a Reply