- Introduction: Why the Groww vs Zerodha Debate Matters

- Company Overview: Groww Vs Zerodha in a Nutshell

- Brokerage & Charges: Groww vs Zerodha Comparison

- Investment Options: Stocks, Mutual Funds, and More

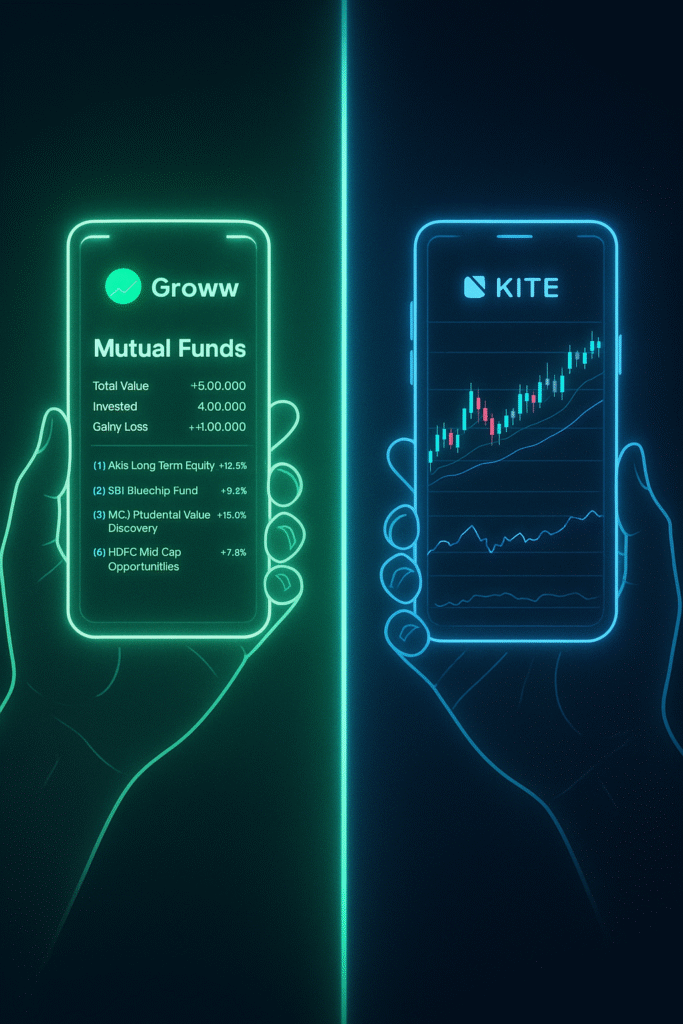

- Mutual Funds: Groww vs Zerodha for Long-Term Investors

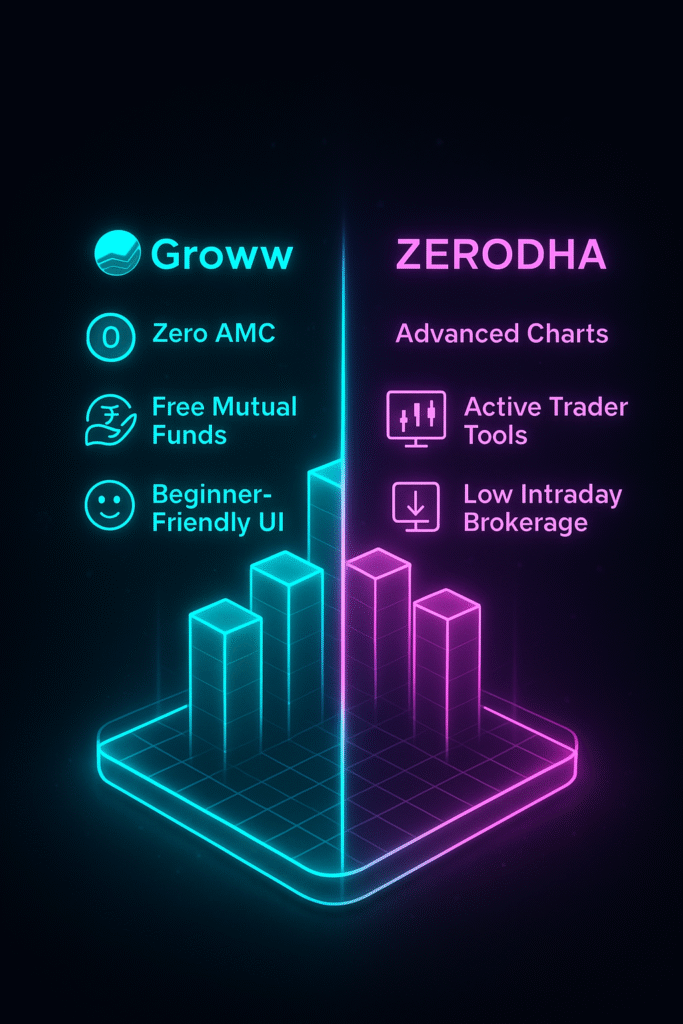

- Trading Tools & Features: Beginner vs Advanced

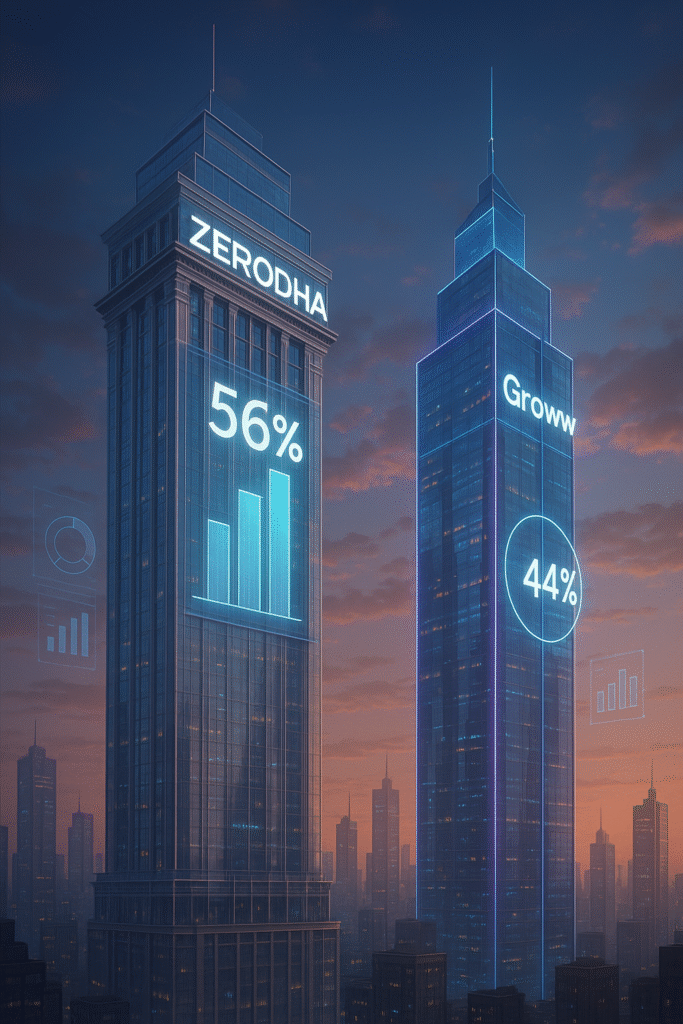

- User Base & Market Share: Who’s Leading in 2025?

- User Base & Market Share: Who’s Leading in 2025?

- Safety & Security: Which Platform Can You Trust?

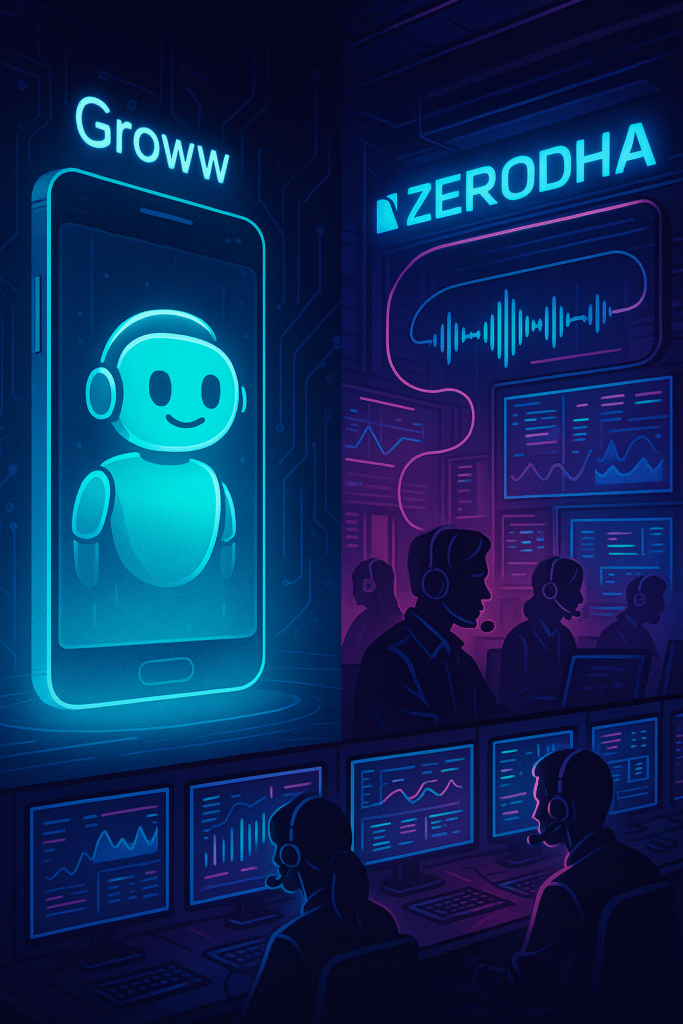

- Customer Support: How Do They Compare?

- Brokerage & Charges: Who’s More Affordable?

- Conclusion: Groww vs Zerodha – Which One Should You Choose?

If you’ve ever searched for the best stock trading app in India, chances are you’ve come across the debate of Groww vs Zerodha. These two platforms dominate conversations among both first-time investors and seasoned traders—and for good reason. Groww promises simplicity and beginner-friendly investing, while Zerodha stands tall as India’s largest discount broker, trusted by millions for its advanced tools and low brokerage fees.

But here’s the catch: choosing between Groww and Zerodha isn’t as simple as it looks. For a beginner, questions like “Which is safer- Groww vs Zerodha?”, “Which app has lower charges- Groww vs Zerodha?”, or “Which is better for long-term investing- Groww vs Zerodha?” are more than just curiosity—they directly impact your financial journey. For active traders, comparing features such as Groww charges, Zerodha brokerage, calculators, and app performance can make or break their trading decisions.

That’s why this guide isn’t just another comparison—it’s the ultimate breakdown of Groww vs Zerodha in 2025. We’ll dig into brokerage charges, app experience, mutual funds, intraday trading, customer support, safety, and even market share. By the end, you’ll know exactly which platform fits your needs—whether you’re a student starting with mutual funds, a long-term investor planning for retirement, or an intraday trader chasing daily profits.

Introduction: Why the Groww vs Zerodha Debate Matters

In 2025, investing in India is no longer limited to stock market veterans. From college students experimenting with mutual funds to young professionals building long-term portfolios, everyone wants an easy and affordable way to grow their wealth. And when it comes to choosing the right platform, the debate of Groww vs Zerodha always comes up.

Both apps are massively popular, but for very different reasons. Groww is designed for simplicity—it started as a mutual fund platform and evolved into a user-friendly trading app where beginners can invest in stocks, ETFs, and more with just a few clicks. Zerodha, on the other hand, is India’s largest discount broker, known for its low brokerage charges, advanced trading platform Kite, and wide range of features that appeal to serious traders.

But here’s why this comparison matters:

- Charges & Fees: With terms like “Groww charges” and “Zerodha brokerage” trending in investor searches, people want to know which platform is truly cost-effective.

- App Experience: While Groww promises simplicity, many ask, “Is Groww better than Zerodha for beginners?” Meanwhile, Zerodha’s Kite app is praised for its power, but may feel overwhelming for first-timers.

- Investment Options: Groww’s strength lies in mutual funds and long-term investing, while Zerodha shines in intraday trading and advanced market tools.

- Trust & Safety: With rising scams in finance apps, questions like “In Groww vs Zerodha, which is safer?

Simply put, the Groww vs Zerodha debate isn’t just about picking an app—it’s about choosing the right financial partner for your journey. Whether you’re chasing quick intraday trades or planning a 20-year retirement strategy, the right choice can save you money, time, and stress.

Company Overview: Groww Vs Zerodha in a Nutshell

About Groww: From Mutual Funds to All-in-One Investing

Groww began in 2016 as a simple app to help young Indians invest in mutual funds without paperwork or complicated jargon. Over the years, it has grown into a full-fledged trading platform, offering:

- Stocks, ETFs, and IPOs

- Mutual funds and SIPs

- A clean, minimalist app interface designed for beginners

One of Groww’s biggest strengths is its simplicity. Whether you’re a college student starting your first SIP or a young professional testing stocks, the Groww app makes investing feel approachable. Features like the Groww calculator and instant Groww login options make it seamless for users to track and manage their investments.

However, critics argue that Groww still has limited advanced features compared to traditional trading platforms, making it better suited for long-term investors and beginners than active traders. Let’s move to the next section of Groww vs Zerodha.

About Zerodha: The Pioneer of Discount Broking in India

Founded in 2010, Zerodha is widely recognized as India’s first discount broker and the company that revolutionized low-cost trading in the country. Today, it serves millions of investors and traders through its flagship platform, Kite by Zerodha.

Here’s what Zerodha is best known for:

- Ultra-low brokerage charges (₹20 or less per trade)

- Advanced trading tools for intraday and F&O trading

- A robust Zerodha calculator for brokerage and margin

- A huge ecosystem of apps, including Kite, Coin (mutual funds), and Varsity (education)

Zerodha’s biggest strength is its power and reliability. It’s the go-to platform for serious traders who need detailed charting, real-time data, and advanced order types. But for complete beginners, the Kite app can feel overwhelming at first compared to Groww’s simplicity.

Brokerage & Charges: Groww vs Zerodha Comparison

When it comes to investing, charges can make or break your returns. Even small brokerage fees add up over time, which is why investors often search for “Groww vs Zerodha brokerage”. Let’s break it down in a simple, side-by-side format.

Groww Charges

Groww has built its reputation around being a low-cost, beginner-friendly app. Here’s how its charges typically work:

- Equity Delivery (Buying Stocks to Hold): Free – no brokerage charges.

- Equity Intraday Trading: ₹20 or 0.05% per executed order (whichever is lower).

- Equity Futures & Options (F&O): ₹20 per executed order.

- Mutual Funds: No commission (direct plans only).

Other costs:

- Account Opening: Often free during promotions.

- Annual Maintenance Charges (AMC): ₹0 for Groww Demat Account.

This makes Groww highly attractive for long-term investors and mutual fund investors, since they don’t need to worry about ongoing costs. Let’s move to a more detailed section of “Groww vs Zerodha” debate.

Zerodha Charges

Zerodha pioneered the discount broking model in India, and its transparent charges are one of its biggest selling points:

- Equity Delivery: Free – no brokerage.

- Equity Intraday Trading: ₹20 or 0.03% per executed order (whichever is lower).

- Equity Futures & Options (F&O): Flat ₹20 per order.

- Mutual Funds (via Coin): Free to invest in direct mutual funds.

Other costs:

- Account Opening: ₹200–₹300 (one-time).

- Annual Maintenance Charges (AMC): Around ₹300 per year.

While Zerodha isn’t always free to maintain, its ultra-low intraday rates make it a favorite for active traders who trade daily and want advanced tools to manage costs.

Groww vs Zerodha Charges: Quick Comparison

| Feature | Groww | Zerodha |

| Equity Delivery | Free | Free |

| Intraday Trading | ₹20 or 0.05% per order | ₹20 or 0.03% per order |

| Futures and Options | ₹20 per order | ₹20 per order |

| Mutual Funds | Free (direct plans) | Free (direct plans) |

| Account Opening | Free (promo) | ₹200–₹300 |

| AMC(Yearly) | Free | ₹300 approx. |

Investment Options: Stocks, Mutual Funds, and More

At the end of the day, the real question investors ask is simple: “What can I invest in with Groww vs Zerodha?” Both platforms open the door to wealth-building, but they serve slightly different audiences and needs. Let’s break it down, Groww vs Zerodha- investment options.

Groww Investment Options

Groww started as a mutual fund investing app and slowly expanded to cover more products. Here’s what you can invest in using the Groww app:

- Stocks: NSE and BSE-listed companies available for equity delivery and intraday.

- Mutual Funds: Wide range of direct plans with zero commission; strong SIP (Systematic Investment Plan) support.

- ETFs (Exchange-Traded Funds): A good entry point for beginners wanting diversified exposure.

- IPOs: Apply for Initial Public Offerings directly through the app.

- Digital Gold: An option for small-ticket investors looking for gold investments.

👉 Overall, Groww’s strength lies in mutual funds and long-term investing, making it a favorite among students, professionals, and beginners.

Zerodha Investment Options

Zerodha offers one of the most comprehensive investment ecosystems in India. Through its apps like Kite, Coin, and Console, investors can access:

- Stocks: NSE, BSE, and intraday trading with advanced order types.

- Futures & Options (F&O): Wide range of derivatives for pro traders.

- Mutual Funds: Direct plans via the Zerodha Coin app, with no commissions.

- ETFs & Commodities: Trade across multiple asset classes.

- Government Securities (G-Secs) & Bonds: Access to safer fixed-income options.

- IPO Investments: Apply seamlessly through Kite.

👉 Zerodha stands out for active traders and diversified investors who want to go beyond just stocks and mutual funds.

Groww vs Zerodha: Investment Choices at a Glance

| Investment Option | Groww | Zerodha |

| Stocks (Equity) | Yes – NSE & BSE | Yes – NSE & BSE |

| Intraday trading | Limited | Advanced (with order types) |

| Mutual Funds | Direct plans, SIP focus | Direct plans via Coin |

| ETFs | Yes | Yes |

| F&0 Trading | Yes | Yes (extensive) |

| Commodities | No | Yes (MCX available) |

| Digital Gold | Yes | No |

| Government Security | No | Yes |

| IPO Application | Yes | Yes |

Mutual Funds: Groww vs Zerodha for Long-Term Investors

For millions of Indians, mutual funds are the gateway to investing. Instead of picking individual stocks, you can invest in a diversified portfolio managed by professionals. But when it comes to Groww vs Zerodha, which platform makes mutual fund investing easier and better? Let’s find out.

Mutual Funds on Groww: Built for Beginners

Groww started as a mutual fund investment platform, and this remains its strongest offering even in 2025. Here’s why it’s so popular among long-term investors:

- Direct Mutual Funds Only: Groww provides direct plans with zero commission, ensuring higher returns compared to regular plans.

- Simple SIP Setup: You can start a SIP in just a few clicks, perfect for beginners and students.

- Mutual Fund Calculator: Groww’s built-in calculator makes it easy to estimate future returns.

- Wide Choice of Funds: From equity funds to debt and hybrid funds, the app covers almost all categories.

- No Account Charges: There are no hidden fees or AMC for mutual fund investors.

👉 Best For: First-time investors, students, and professionals who want a hassle-free mutual fund experience.

Mutual Funds on Zerodha (Coin): Built for Serious Investors

Zerodha offers mutual funds through its Coin platform, which is tightly integrated with the Kite trading app. While it also focuses on direct plans, it caters more to serious investors who want deeper insights and control.

Key features of Zerodha Coin:

- Direct Mutual Funds, Zero Commission: Just like Groww, you only get direct plans.

- Portfolio Integration: Your mutual funds sit alongside your stocks and bonds in one portfolio view.

- Advanced Tracking Tools: Track returns, risk metrics, and historical performance more deeply than Groww.

- Seamless Switching: Easily move between different mutual funds for portfolio rebalancing.

- Charges: No commission on funds, but AMC of around ₹300/year applies to your Zerodha account.

👉 Best For: Experienced investors who want to actively monitor, switch, and rebalance portfolios.

Groww vs Zerodha for Mutual Funds: At a Glance

| Feature | Groww | Zerodha (Coin) |

| Mutual Fund Plans | Direct plans only | Direct plans only |

| Comission | Zero | Zero |

| Ease of Use | Very easy, beginner-friendly | More advanced, learning curve |

| SIP Setup | Quick and simple | Available but less intuitive |

| Portfolio Integration | Focused on mutual funds | Integrated with stocks & bonds |

| Charges | ₹0 (no AMC for mutual funds) | ₹300/year AMC (Demat account) |

Trading Tools & Features: Beginner vs Advanced

When comparing Groww vs Zerodha, one of the biggest differences lies in their trading tools and features. Groww focuses on making investing easy for toolkit for active and professional traders. Let’s explore the contrast.

Groww Trading Tools: Keep It Simple

Groww’s trading platform is designed with new investors in mind. It avoids clutter and keeps features minimal to ensure beginners don’t feel lost.

Key Groww features include:

- Basic Charts: Line and candlestick charts with simple timeframes.

- Watchlists: Track your favorite stocks, ETFs, and mutual funds easily.

- Price Alerts: Get notified when a stock hits your target price.

- Order Types: Basic buy/sell and SIP options for mutual funds.

- Groww Calculator: Quick return estimates for SIPs and investments.

👉 Best For: New investors who want to buy, hold, and track without getting overwhelmed by advanced analysis.

Zerodha Trading Tools: Advanced & Professional

Zerodha shines when it comes to powerful trading tools, making it India’s go-to platform for intraday and F&O traders. Its flagship app, Kite Zerodha, is loaded with features that Groww doesn’t offer. So in the debate of Groww vs Zerodha, there can be a difference maker now.

Key Zerodha tools include:

- Pro Charts: Multiple chart types, 100+ technical indicators, and drawing tools.

- Advanced Order Types: Cover orders, bracket orders, and GTT (Good Till Triggered).

- Option Chain Analysis: Built-in option trading tools for F&O traders.

- Seamless API Access: For algo traders and developers to automate trades.

- Margin Calculator: To check leverage and margin requirements in real time.

- Zerodha Varsity: A free education platform to learn trading strategies.

👉 Best For: Intraday traders, F&O traders, and professionals who need speed, precision, and advanced analytics.

Groww vs Zerodha: Trading Features Face-Off

| Feature | Groww | Zerodha (Kite) |

| Charting Tools | Basic charts, limited indicators | Advanced charts, 100+ indicators |

| Order Types | Basic buy/sell | Advanced (Cover, Bracket, GTT) |

| Mutual Fund Tools | SIP calculator, fund tracking | Integrated with Coin app |

| Options Trading | Very limited | Extensive option chain analysis |

| API and Algo Trading | Not available | Available via Kite API |

| Learning Resources | Blog, simple guides | Zerodha Varsity (detailed modules) |

User Base & Market Share: Who’s Leading in 2025?

When deciding between Groww vs Zerodha, many investors look at trust and popularity. After all, if millions of people are using one platform over another, it says something about reliability. So, who’s winning in the race of Groww vs Zerodha?

Zerodha: The Veteran with Massive Market Share

Zerodha has been in the game since 2010, and over the years, it has built a reputation as the largest stockbroker in India. Known for pioneering the discount broking model, Zerodha consistently ranks at the top when it comes to active clients and daily trade volumes.

- Active Clients (2025 estimate): Over 7–8 million

- Market Share: Around 15–18% of all retail trading in India

- Strength: Trust, reliability, and dominance in active trading & F&O markets

👉 Simply put, Zerodha remains the go-to choice for serious traders who want low costs and pro tools.

Groww: The New-Age Challenger Rising Fast

Groww may be newer, but it has taken the investing world by storm. Launched in 2016, it has quickly grown from a mutual fund platform to a multi-investment app for stocks, ETFs, and IPOs.

- Active Clients (2025 estimate): Over 6–7 million

- Market Share: Growing rapidly, especially in mutual funds and long-term investing

- Strength: Beginner-friendly design that appeals to students, first-time investors, and professionals

👉 In just a few years, Groww has managed to challenge Zerodha’s dominance, proving that simplicity and accessibility can compete with advanced trading features.

Groww vs Zerodha Market Share: Side-by-Side

| Metric | Zerodha | Groww |

| Launch Year | 2010 | 2016 |

| Active Clients | 7-8 million approx | 6-7 million approx |

| Market Share | 15-18% | 12–14% (rapidly rising) |

| Core strength | Advanced trading & low brokerage | Mutual funds & beginner investors |

User Base & Market Share: Who’s Leading in 2025?

When deciding between Groww vs Zerodha, many investors look at trust and popularity. After all, if millions of people are using one platform over another, it says something about reliability. So, who’s winning in 2025—Groww or Zerodha?

Zerodha: The Veteran with Massive Market Share

Zerodha has been in the game since 2010, and over the years, it has built a reputation as the largest stockbroker in India. Known for pioneering the discount broking model, Zerodha consistently ranks at the top when it comes to active clients and daily trade volumes.

- Active Clients (2025 estimate): Over 7–8 million

- Market Share: Around 15–18% of all retail trading in India

- Strength: Trust, reliability, and dominance in active trading & F&O markets

👉 Simply put, Zerodha remains the go-to choice for serious traders who want low costs and pro tools.

Groww: The New-Age Challenger Rising Fast

Groww may be newer, but it has taken the investing world by storm. Launched in 2016, it has quickly grown from a mutual fund platform to a multi-investment app for stocks, ETFs, and IPOs.

- Active Clients (2025 estimate): Over 6–7 million

- Market Share: Growing rapidly, especially in mutual funds and long-term investing

- Strength: Beginner-friendly design that appeals to students, first-time investors, and professionals

👉 In just a few years, Groww has managed to challenge Zerodha’s dominance, proving that simplicity and accessibility can compete with advanced trading features.

Safety & Security: Which Platform Can You Trust?

No matter how attractive the features or charges may look, the first question every investor asks is: “Is my money safe?” When comparing Groww vs Zerodha, understanding their safety, regulations, and reliability is crucial.

Groww Security: Simple, Safe, and SEBI-Regulated

Groww is a SEBI-registered stockbroker and investment advisor, which means it operates under strict regulatory oversight.

Here’s how Groww ensures safety:

- Regulatory Compliance: Registered with SEBI, NSE, and BSE.

- Investor Protection: Client funds are kept separate from company funds.

- Data Security: Uses bank-grade encryption and secure Groww login (including biometrics).

- Mutual Fund Safety: Investments are directly held with AMCs (Asset Management Companies), not Groww itself, ensuring transparency.

👉 Bottom Line: Groww is safe for beginners, especially for mutual fund and stock investing, though it lacks the legacy trust of Zerodha.

Zerodha Security: Proven Trust Over a Decade

Zerodha is widely regarded as one of the most trusted brokers in India, thanks to its long history and large customer base.

Here’s how Zerodha ensures safety:

- Regulatory Compliance: Registered with SEBI, NSE, BSE, and MCX.

- Segregated Accounts: Client funds are always separated from company accounts.

- Two-Factor Authentication: Secure login with multi-layered verification.

- Track Record: Over a decade of handling millions of trades daily without major breaches.

- Education for Safety: Through Zerodha Varsity, it educates investors on safe trading practices.

👉 Bottom Line: Zerodha’s decade-long presence and robust compliance make it one of the most reliable brokers in India.

Groww vs Zerodha Safety Comparison

| Safety Factor | Groww | Zerodha |

| Regulation | SEBI, NSE, BSE | SEBI, NSE, BSE, MCX |

| Track Record | Newer (since 2016) | Proven (since 2010) |

| Login security | Biometric login, encryption | Two-factor authentication, encryption |

| Fund safety | Segregated accounts, AMC direct funds | Segregated accounts |

| Customer trust | Rapidly growing trust among beginners | Long-standing trust among traders |

Customer Support: How Do They Compare?

When investing, smooth customer support can make or break your experience. Whether it’s a query about brokerage charges, login issues, or trade execution, investors need quick, reliable, and easy-to-access help. So, between Groww vs Zerodha, who handles customer support better?

Groww Customer Support: Easy, But Limited Options

Groww focuses heavily on its digital-first approach, and that reflects in its customer support.

- Support Channels: Help is primarily available via in-app support, email, and FAQs.

- Response Time: Quick for basic queries, but slower for complex trading issues.

- Ease of Use: App-based ticket system is beginner-friendly and works well for mutual fund or SIP-related questions.

- Limitation: No direct phone support, which can frustrate users facing urgent trading problems.

👉 Best suited for new investors who mostly need help with mutual funds, SIPs, or stock basics.

Zerodha Customer Support: Wider, More Reliable

Zerodha, being an older platform with a huge client base, has built a structured support system over the years.

- Support Channels: Offers phone support, email, ticket system, and a dedicated support portal (support.zerodha.com).

- Response Time: Usually faster for urgent queries, especially for trading-related concerns.

- Knowledge Base: Extensive resources through Zerodha Varsity and FAQs.

- Limitation: During peak market hours, response times can be slower due to the huge client base.

👉 Best suited for active traders who need quick assistance with live trades, charts, or brokerage issues.

Groww vs Zerodha Support Comparison

| Support factor | Groww | Zerodha |

| Support Channels | In-app, Email, FAQ’s | Phone, Email, Tickets, Knowledge Base |

| Response speed | Quick for simple queries | Faster for trading issues |

| Beginner Help | Strong for SIPs, mutual funds | Extensive via Varsity + FAQs |

| Urgent Assistance | Limited | More reliable |

Brokerage & Charges: Who’s More Affordable?

For many investors, the real question is simple: “How much will it cost me to trade?” Brokerage and hidden charges can eat into profits, especially for active traders. Let’s break down how Groww vs Zerodha compare in 2025 when it comes to charges, brokerage, and hidden fees.

Groww Charges: Simplified Pricing for Beginners

Groww entered the market with a zero-commission promise on mutual funds, which helped it attract millions of first-time investors.

- Equity Delivery: ₹0 (free)

- Equity Intraday: ₹20 or 0.05% per executed order (whichever is lower)

- Futures & Options (F&O): ₹20 per order

- Mutual Funds: Zero commission

- Account Opening: ₹0 (no charges)

- AMC (Annual Maintenance): ₹0

👉 Bottom Line: Groww keeps things simple and beginner-friendly, making it ideal for those who want mutual funds and occasional stock trading without worrying about hidden fees.

Zerodha Charges: Low-Cost Pioneer for Traders

Zerodha is known for introducing the discount broking model in India, making trading much cheaper than traditional brokers.

- Equity Delivery: ₹0 (free)

- Equity Intraday: ₹20 or 0.03% per executed order (whichever is lower)

- Futures & Options (F&O): ₹20 per order

- Mutual Funds (via Coin): ₹0 direct mutual fund investments

- Account Opening: ₹200–300 (one-time)

- AMC (Annual Maintenance): ₹300 per year

👉 Bottom Line: Zerodha is still the king of low-cost trading for active traders, especially those dealing in intraday and F&O segments.

Groww vs Zerodha Charges Comparison

| Charge Type | Groww | Zerodha |

|---|---|---|

| Equity Delivery | ₹0 | ₹0 |

| Intraday Trading | ₹20 or 0.05% | ₹20 or 0.03% |

| F&O Trading | ₹20 per order | ₹20 per order |

| Mutual Funds | Free (direct plans) | Free (direct plans via Coin) |

| Account Opening | ₹0 | ₹200–₹300 |

| AMC (Annual Fee) | ₹0 | ₹300 per year |

Conclusion: Groww vs Zerodha – Which One Should You Choose?

When it comes to Groww vs Zerodha, there’s no one-size-fits-all answer—it all depends on your investing style and goals.

- If you’re a beginner or a long-term investor who prefers mutual funds, SIPs, and a clean, easy-to-use app, Groww is your best bet. With zero account charges, free mutual funds, and a simple interface, it’s built for newcomers who want to start investing without feeling overwhelmed.

- On the other hand, if you’re a serious trader or someone who actively invests in intraday, futures, or options, Zerodha remains the undisputed leader. Its Kite platform, slightly cheaper intraday charges, and proven track record make it the go-to choice for experienced traders.

👉 Groww vs Zerodha- The smart approach? Pick based on your needs. If you’re just starting, Groww is perfect. If you’re ready to level up with advanced charts and tools, Zerodha is the way to go.

At the end of the day, both platforms are safe, SEBI-regulated, and highly reliable—making India’s stock market more accessible than ever.

⚡ In Groww vs Zeordha, remember: the best investment is not just in the platform, but in your financial knowledge and discipline.

Leave a Reply