- Why capital budgeting decides a company’s future?

- The Role of Capital Budgeting in Financial Management

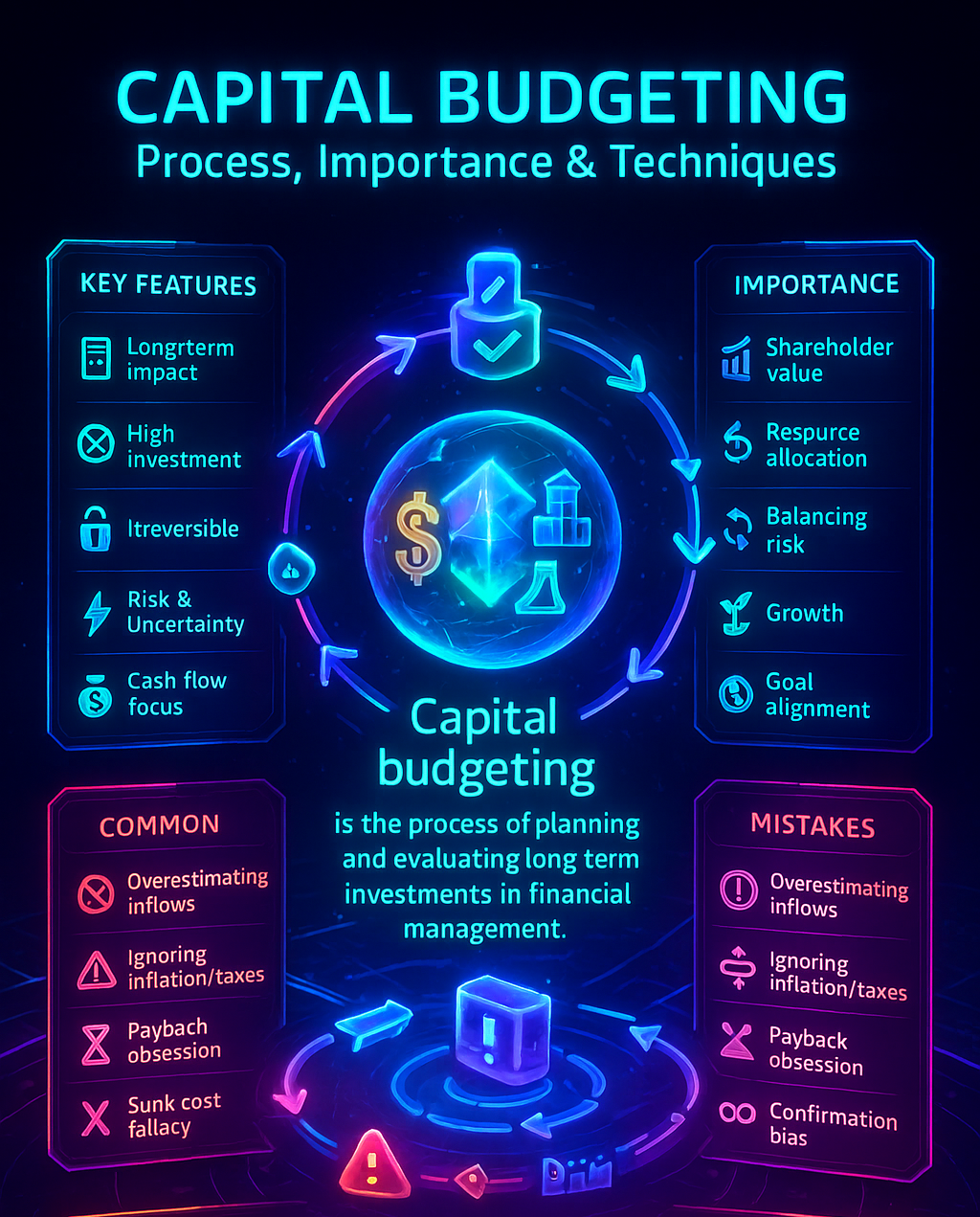

- Key Features of Capital Budgeting Decisions

- The Full Capital Budgeting Process — Step by Step

- Step 1 — Identifying and Screening Opportunities

- Step 2 — Forecasting Incremental Cash Flows

- Step 3 — Choosing the Discount Rate (Cost of Capital)

- Step 4 — Evaluating Using Multiple Methods

- Step 5 — Risk Analysis and Scenario Planning

- Step 6 — Decision-Making and Implementation

- Step 7 — Post-Implementation Review

- Capital Budgeting Techniques & Methods — Deep Dive

- Net Present Value (NPV) — The Gold Standard

- Internal Rate of Return (IRR) — The Percentage Perspective

- Payback Period — The Simplicity Factor

- Discounted Payback Period — The Improved Version

- Profitability Index (PI) — Return per Dollar Invested

- Adjusting for Inflation and Taxes

- When to Use Which Technique

- Advanced Techniques in Capital Budgeting

- Worked Example — Step-by-Step NPV Calculation in Capital Budgeting

- Capital Budgeting vs. Capital Structure — Understanding the Difference

- Importance and Significance of Capital Budgeting in Business

- Common Mistakes and Biases in Capital Budgeting

- Conclusion

Why capital budgeting decides a company’s future?

Every major corporate decision — building a factory, launching a new product line, buying a fleet of trucks, upgrading a data center — starts with one question: is this the best use of scarce funds? That question is answered through capital budgeting. This process turns uncertainty into decisions by modeling cash flows, risk, and returns over years or decades.

Good leaders treat capital budgeting like a discipline. It’s not bureaucracy; it’s survival. Done well, it multiplies shareholder value, avoids expensive mistakes, and forces clarity about assumptions. Done poorly, it produces sunk costs and projects that haunt the balance sheet.

In this guide you’ll get:

- A clear definition and why capital budgeting matters right now.

- A step‑by‑step walkthrough of the capital budgeting process.

- Deep dives into methods: NPV, IRR, payback, profitability index, and advanced models (Monte Carlo, real options).

- A real worked example with step‑by‑step math.

- Practical tips, common mistakes, and content you can share or cite.

The Role of Capital Budgeting in Financial Management

In the world of corporate decision-making, capital budgeting is more than just a spreadsheet exercise — it’s the compass that guides a company toward long-term profitability and sustainability. Within financial management, it serves as the bridge between strategic vision and actionable investment decisions.

When executives talk about growing market share, expanding into new territories, or upgrading production capabilities, they are essentially talking about projects that require capital budgeting. Without a structured capital budgeting process, even the most ambitious strategies risk collapsing under poor planning, inflated expectations, or misallocated resources.

Why Capital Budgeting is Central to Financial Management

- Allocating Scarce Resources Wisely

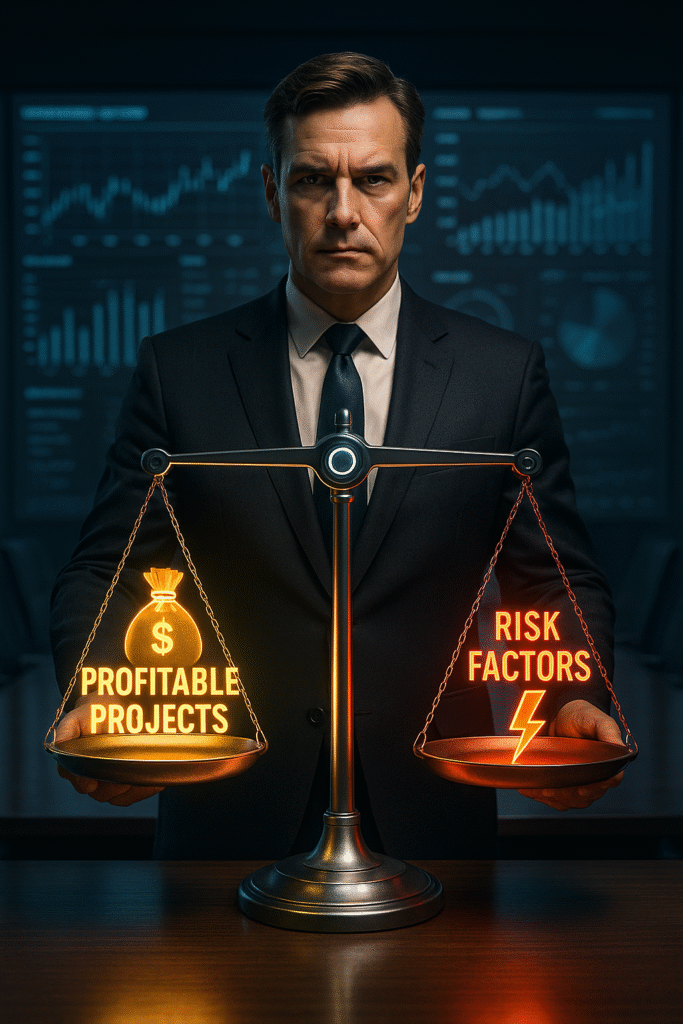

Every organization has finite capital. Through capital budgeting techniques such as Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period, businesses can filter dozens of potential investments down to those that truly deliver maximum return. - Balancing Risk and Return

Good financial management is about optimizing the relationship between risk and reward. Capital budgeting models incorporate sensitivity analysis, inflation adjustments, and risk factors so companies can confidently move forward with projects that align with their risk tolerance. - Shaping Long-Term Direction

The projects selected through capital budgeting define where a company will be in five, ten, or even twenty years. Approving a $50 million expansion today is essentially making a bet on what the market will look like a decade from now. - Enhancing Shareholder Confidence

Investors and stakeholders are far more likely to trust a company that demonstrates disciplined use of capital budgeting methods. By showing how projects are evaluated and selected, management builds credibility and reduces perceived risk.

Key Features of Capital Budgeting Decisions

When companies decide to commit large sums of money to a project, they aren’t just crunching numbers — they’re making strategic commitments that can define their financial trajectory for years to come. Capital budgeting decisions carry unique characteristics that set them apart from routine financial choices. These features not only shape the capital budgeting process but also influence a company’s long-term performance in financial management.

1. Long-Term Impact

Unlike short-term operational expenses, capital budgeting decisions often extend over multiple years — sometimes decades. Whether it’s building a new manufacturing plant or investing in cutting-edge technology, the outcomes of these choices affect future profitability, cash flow, and competitive positioning.

2. Significant Initial Investment

Most capital budgeting techniques are designed to evaluate projects that require substantial capital outlays. For example, a $20 million expansion project is not something a company can reverse overnight. This high commitment means the stakes are higher, making accurate forecasting and thorough risk analysis essential.

3. Irreversibility

Once a capital budgeting decision is made and funds are deployed, reversing it is costly or impossible. A factory built in one location cannot easily be relocated, and the sunk costs are often unrecoverable. That’s why capital budgeting models focus heavily on front-end evaluation before any resources are committed.

4. Risk and Uncertainty

Future market conditions, inflation rates, and technological changes can all impact project viability. A solid capital budgeting process incorporates sensitivity analysis and scenario planning to prepare for these uncertainties. Ignoring this can lead to projects that drain rather than generate value.

5. Cash Flow Orientation

Capital budgeting decisions revolve around expected future cash flows rather than just accounting profits. The timing, size, and risk profile of these cash flows are analyzed using tools like Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period — each providing a different perspective on project feasibility.

6. Strategic Alignment

Every capital budgeting decision must align with the company’s broader strategic goals. For instance, approving a renewable energy project may align with sustainability objectives, while an overseas expansion may support market diversification. This alignment ensures that capital is deployed where it can create the most long-term value.

7. Consideration of Inflation and Cost of Capital

A realistic capital budgeting evaluation always factors in inflation, as it can erode the real value of returns. Likewise, the cost of capital — the minimum rate of return expected by investors — is used as a benchmark for project approval.

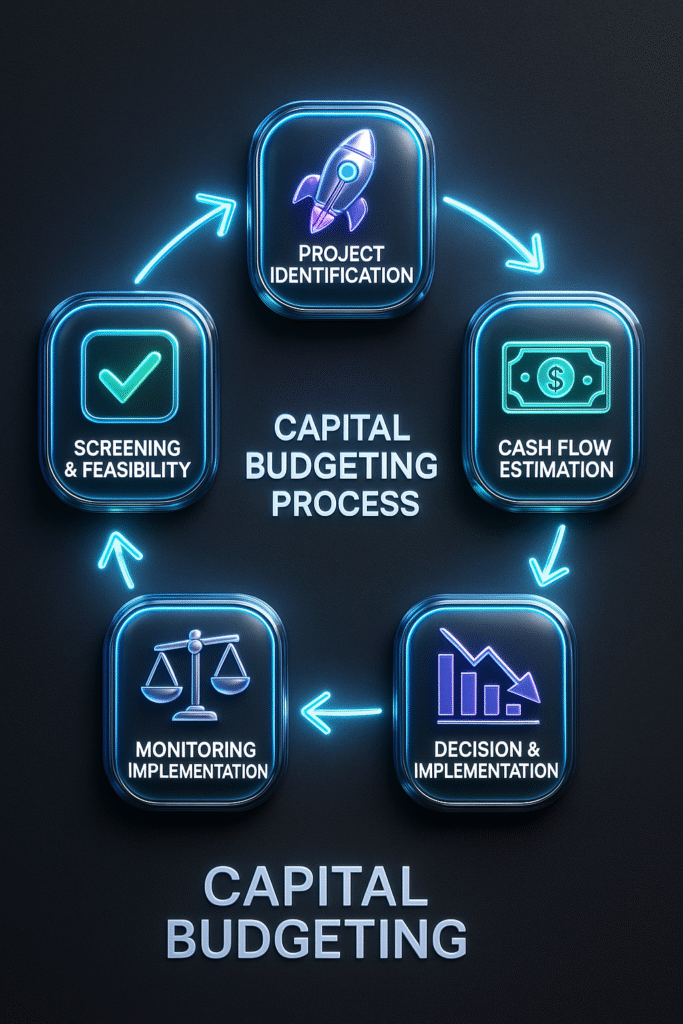

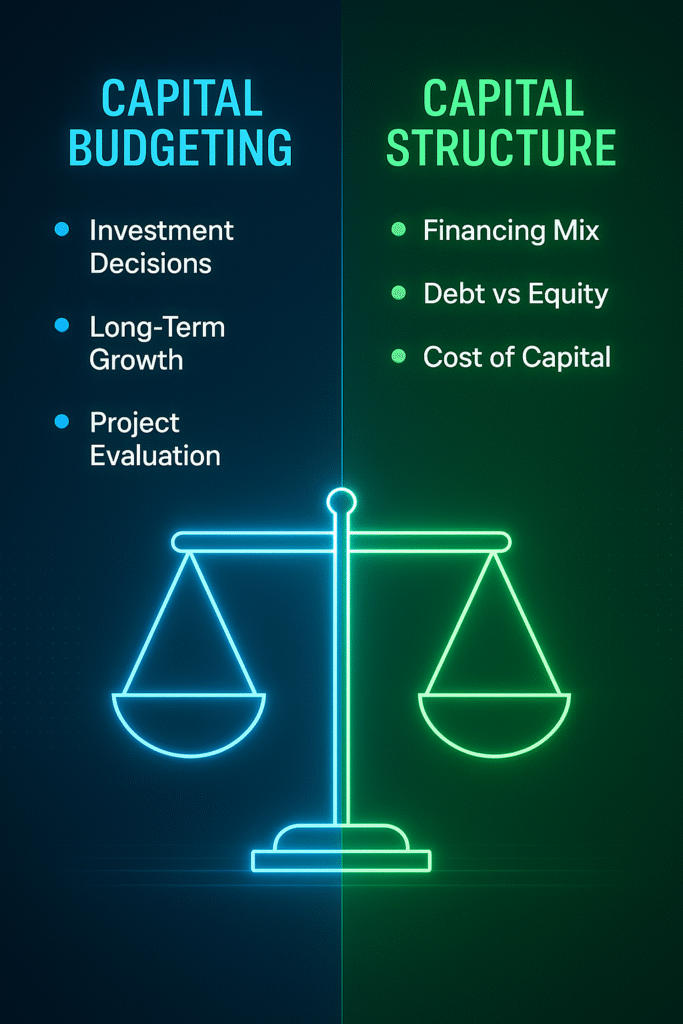

The Full Capital Budgeting Process — Step by Step

The capital budgeting process is the backbone of sound investment decision-making in any business. It’s not just about selecting projects — it’s about systematically ensuring that every dollar invested contributes meaningfully to the company’s long-term growth, profitability, and strategic direction. In financial management, this process acts as a filter that screens out risky, low-return ventures and prioritizes those that align with corporate goals.

Below is the complete capital budgeting process, broken down into clear, actionable steps.

Step 1 — Identifying and Screening Opportunities

Every capital budgeting journey begins with spotting potential investment opportunities. These can range from launching a new product line to acquiring another company. The key here is to consider both the strategic importance and the potential for generating strong, predictable cash flows.

For example:

- A tech company might evaluate whether developing a new AI product is worth the risk.

- A manufacturing firm might explore upgrading machinery to improve efficiency.

At this stage, it’s about casting the net wide but applying an initial filter based on the company’s vision and market conditions.

Step 2 — Forecasting Incremental Cash Flows

Once an opportunity is shortlisted, the next step is estimating incremental cash flows — the additional cash generated (or lost) if the project moves forward. This is where capital budgeting techniques become critical. Analysts must consider:

- Revenue projections

- Operating costs

- Tax implications

- Residual or salvage value at the project’s end

Forecasting must be realistic, incorporating market trends, inflation, and competition.

Step 3 — Choosing the Discount Rate (Cost of Capital)

The discount rate reflects the company’s cost of capital — the return required to make the project worthwhile. In the capital budgeting process, this rate is used in calculations like Net Present Value (NPV) to translate future cash flows into present-day values.

Factors that influence the discount rate include:

- Weighted Average Cost of Capital (WACC)

- Risk premium for the project type

- Inflation expectations

Step 4 — Evaluating Using Multiple Methods

No single capital budgeting method is perfect. That’s why financial managers typically use a combination:

- NPV (Net Present Value) — Measures total value created in present terms.

- IRR (Internal Rate of Return) — Finds the rate at which NPV becomes zero.

- Payback Period — Determines how long it takes to recover the initial investment.

- Profitability Index — Compares benefits to costs.

Using multiple methods provides a more complete view and helps avoid biases.

Step 5 — Risk Analysis and Scenario Planning

Even the best-looking projects can fail due to unforeseen circumstances. That’s why risk analysis is a non-negotiable step in capital budgeting. Techniques include:

- Sensitivity Analysis — Testing how changes in one variable affect outcomes.

- Scenario Analysis — Comparing best-case, worst-case, and most-likely scenarios.

- Monte Carlo Simulation — Running thousands of possible outcomes for better probability estimates.

Step 6 — Decision-Making and Implementation

After thorough analysis, management decides whether to proceed. Once approved, the project moves into the implementation phase — securing resources, coordinating teams, and ensuring timelines are met.

A disciplined capital budgeting process ensures that decision-making is based on facts, not just optimism.

Step 7 — Post-Implementation Review

A truly effective capital budgeting process doesn’t end when the project is launched. Companies should track actual performance against forecasts, identifying gaps and learning lessons for future investments. This step reinforces accountability and builds institutional knowledge.

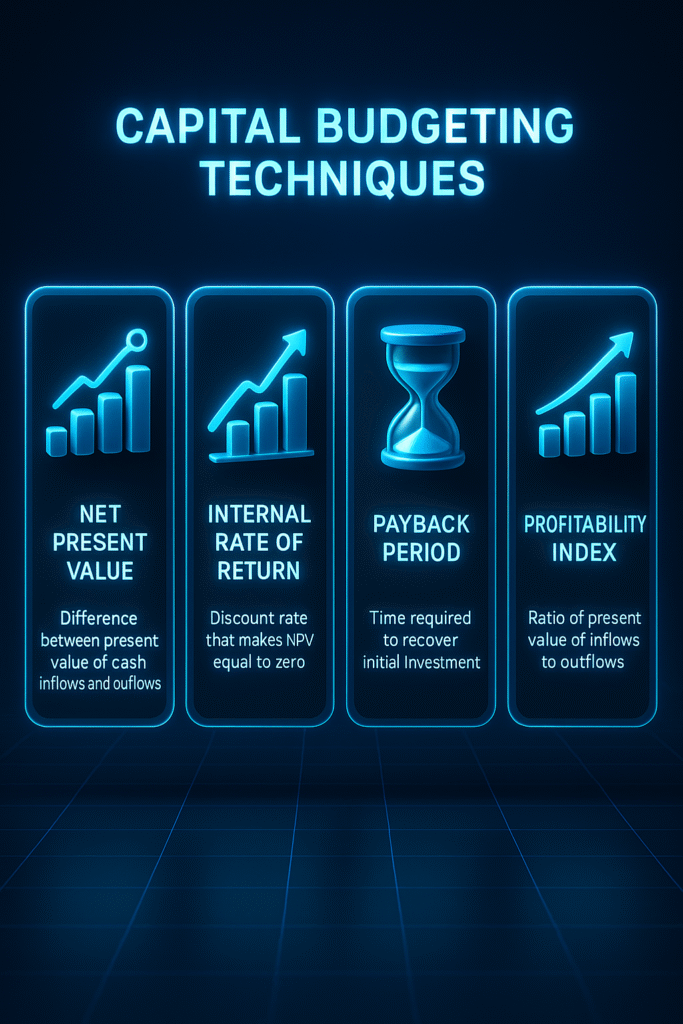

Capital Budgeting Techniques & Methods — Deep Dive

The beauty of capital budgeting lies in its ability to turn a complex investment decision into a numbers-backed, logical conclusion. While the capital budgeting process provides the structure, the techniques and methods are the tools that make evaluation possible.

These methods are not just mathematical formulas; they’re decision-making frameworks that help businesses choose between competing projects, assess risk, and ensure every investment aligns with long-term goals in financial management.

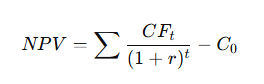

Net Present Value (NPV) — The Gold Standard

Definition: NPV calculates the difference between the present value of cash inflows and the present value of cash outflows over a project’s life.

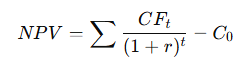

Where:

- CFtCF_tCFt = Cash flow at time t

- rrr = Discount rate (Cost of Capital)

- C0C_0C0 = Initial investment

Why it matters:

- NPV tells you the exact dollar value a project adds to the company.

- A positive NPV means the project should increase shareholder value.

Example:

If a $100,000 project generates $30,000 annually for 5 years at a 10% discount rate, its NPV will reveal whether it’s worth pursuing.

Internal Rate of Return (IRR) — The Percentage Perspective

Definition: IRR is the discount rate at which a project’s NPV equals zero.

Decision Rule: If IRR > cost of capital, accept the project.

Why it’s useful:

- Easy for executives to understand as a percentage return.

- Helps compare projects with different scales and lifespans.

Drawback:

IRR can be misleading for projects with non-standard cash flows (cash flows changing signs multiple times).

Payback Period — The Simplicity Factor

Definition: The time it takes for an investment to generate enough cash inflows to recover its initial cost.

Why companies use it:

- Simple to calculate and easy to explain.

- Good for projects where liquidity and quick recovery are important.

Limitation:

It ignores the time value of money (unless using the Discounted Payback Period) and cash flows beyond the payback point.

Discounted Payback Period — The Improved Version

Definition: Similar to the payback period but considers the time value of money by discounting future cash flows before calculating recovery time.

Benefit:

More accurate than the regular payback period, especially in high-inflation environments.

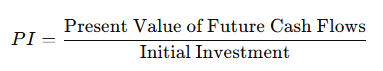

Profitability Index (PI) — Return per Dollar Invested

Interpretation:

- PI > 1 → Accept the project

- PI < 1 → Reject the project

Why it’s powerful:

Useful when capital is rationed, as it ranks projects by value created per dollar invested.

Adjusting for Inflation and Taxes

Inflation directly impacts the real value of returns, and taxes can significantly reduce profitability.

A well-designed capital budgeting model always factors these in to avoid overestimating the project’s benefits.

When to Use Which Technique

| Technique | Best For | Limitation |

| NPV | Maximizing shareholder value | Needs accurate discount rate |

| IRR | Comparing % returns | Misleading with non-standard cash flows |

| Payback Period | Quick liquidity | Ignores time value of money |

| Discounted Payback Period | Inflation-adjusted recovery | Ignores post-payback cash flows |

| Profitability Index | Ranking projects | Requires NPV data |

Advanced Techniques in Capital Budgeting

Traditional capital budgeting techniques like NPV and IRR are powerful, but in today’s volatile, uncertain, and rapidly changing business environment, companies often need more sophisticated tools. Advanced methods go beyond simple cash flow analysis and help decision-makers factor in uncertainty, flexibility, and risk in a much more realistic way.

Here are the most impactful advanced capital budgeting methods every financial manager should know.

Sensitivity Analysis — Testing “What If” Scenarios

Definition: Sensitivity analysis measures how changes in one input (like sales volume, discount rate, or project cost) impact the outcome of a project.

Why it matters in capital budgeting:

- It shows which variables are the most critical to project success.

- Helps managers identify potential weak points before committing capital.

Example: If a project’s NPV turns negative when raw material costs rise by just 5%, managers know that cost control will be crucial.

👉 Sensitivity analysis answers the question: “How sensitive is my project’s success to changes in assumptions?”

Scenario Analysis — Best Case, Worst Case, and Most Likely

Definition: Scenario analysis evaluates multiple sets of assumptions at once — creating best-case, worst-case, and most-likely outcomes.

Application in capital budgeting:

- Best Case: Strong market demand, stable costs, favorable tax conditions.

- Worst Case: Low sales, rising inflation, higher tax burdens.

- Most Likely: A realistic mix of both.

Why it’s useful: It gives management a range of possible outcomes, helping them prepare contingency plans rather than relying on a single forecast.

Monte Carlo Simulation — Bringing Probability Into the Mix

Definition: Monte Carlo simulation runs thousands of possible scenarios using random variables (like sales, costs, or interest rates) to estimate the probability of different outcomes.

Why it’s powerful in capital budgeting:

- Instead of a single NPV number, managers see the full distribution of possible NPVs.

- Provides a probability that a project will generate a positive return.

- Helps identify risk levels more precisely.

Example: A Monte Carlo simulation might show that a project has a 70% chance of achieving an NPV above $1 million and a 30% chance of falling short. This insight makes risk management far more data-driven.

Real Options Approach — Flexibility as a Value Driver

Definition: Real options treat investment decisions like financial options, giving managers the right — but not the obligation — to expand, delay, abandon, or modify a project depending on how circumstances evolve.

Types of Real Options in Capital Budgeting:

- Option to Delay — Postpone a project until market conditions improve.

- Option to Expand — Increase investment if the project performs well.

- Option to Abandon — Shut down a project early if losses mount.

- Option to Switch — Redirect resources to more profitable uses.

Why it’s game-changing: Traditional NPV ignores flexibility, but real-world projects often require it. The real options approach recognizes the strategic value of keeping choices open.

Inflation and Risk-Adjusted Models

While basic models may assume constant cash flows, advanced capital budgeting models adjust for inflation, fluctuating interest rates, and risk premiums. These adjustments make the projections more realistic, especially for long-term projects in volatile economies.

When Should Companies Use Advanced Techniques?

- When projects involve high uncertainty (new technologies, emerging markets).

- When management needs to compare multiple strategic directions.

- When the capital budgeting process involves long time horizons (10+ years).

- When inflation, taxes, or risk levels are especially unpredictable.

Worked Example — Step-by-Step NPV Calculation in Capital Budgeting

One of the best ways to truly understand capital budgeting is to walk through a real-world style example. Numbers make the concept tangible, and when readers see how NPV is calculated step by step, the importance of capital budgeting techniques becomes crystal clear.

Let’s say a company is considering investing in a new production machine. Here’s the setup:

- Initial Investment (C₀): $100,000

- Expected Life of Project: 5 years

- Annual Cash Inflows: $30,000

- Discount Rate (Cost of Capital): 10%

- Salvage Value at End of Year 5: $10,000

Now, let’s calculate the Net Present Value (NPV).

Step 1 — Identify Cash Flows

- Initial Outflow: $100,000 (Year 0)

- Cash Inflows: $30,000 per year (Years 1–5)

- Salvage Value: $10,000 at the end of Year 5

Step 2 — Apply the NPV Formula

Where:

- CFtCF_tCFt = Cash inflows in year t

- rrr = Discount rate (10%)

- C0C_0C0 = Initial investment ($100,000)

Step 3 — Discount Each Cash Flow

Step 4 — Add Discounted Values

Total Present Value of Inflows =

27,273 + 24,793 + 22,539 + 20,490 + 18,627 + 6,209 = $119,931

Step 5 — Subtract Initial Investment

NPV=119,931−100,000=19,931

Final Answer

The project has an NPV of $19,931.

Since NPV is positive, the company should accept the project — it will add value to shareholders.

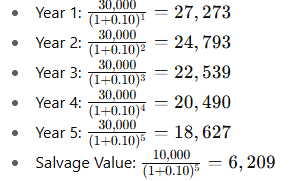

Capital Budgeting vs. Capital Structure — Understanding the Difference

In financial management, two concepts often get mentioned together but serve entirely different purposes: capital budgeting and capital structure. While they’re connected in shaping a company’s financial health, they answer very different questions.

- Capital Budgeting asks: Where should the company invest its funds?

- Capital Structure asks: How should the company finance those investments?

What is Capital Budgeting?

As we’ve explored, capital budgeting is the process of evaluating long-term investments — like machinery, new product launches, or expansion projects — to determine whether they add value to the business.

It focuses on:

- Project selection

- Estimating future cash flows

- Applying capital budgeting techniques (NPV, IRR, Payback, etc.)

- Ensuring projects align with company goals

👉 Simply put, capital budgeting = decision-making on investments.

What is Capital Structure?

Capital structure, on the other hand, deals with how those investments are financed. It’s the mix of debt and equity a company uses to fund its operations and projects.

- Debt Financing: Loans, bonds, or other borrowings.

- Equity Financing: Issuing shares, retained earnings, or venture capital.

The optimal capital structure balances risk and return — too much debt can lead to financial distress, while too much equity may dilute ownership and reduce returns.

👉 In short, capital structure = the financial mix used to fund investments.

Key Differences Between Capital Budgeting and Capital Structure

| Aspect | Capital Budgeting | Capital Structure |

| Definition | Evaluating long-term investment projects | Determining the mix of debt and equity financing |

| Core Question | Should we invest in this project? | How should we finance the project? |

| Focus | Cash inflows, outflows, profitability, risk | Cost of capital, debt-equity ratio, financial risk |

| Time Horizon | Project-specific (long-term) | Company-wide (ongoing) |

| Techniques Used | NPV, IRR, Payback, PI, Real Options | Debt-to-equity ratio, WACC, leverage analysis |

How They Work Together

Even though they’re distinct, capital budgeting and capital structure are deeply interconnected:

- The results of capital budgeting decisions determine how much funding is needed.

- The capital structure decision then decides how to finance that requirement.

- A higher reliance on debt in the capital structure increases the company’s cost of capital, which in turn affects the results of capital budgeting models like NPV and IRR.

Example:

If a project requires $10 million and the company chooses to finance it with mostly debt, the higher interest costs will increase the discount rate, potentially making the project less attractive.

Why Distinguishing Them Matters

Many beginners confuse capital budgeting vs. capital structure — but understanding the difference is essential for sound financial management. Together, they ensure:

- The right projects are chosen (capital budgeting).

- The projects are financed in the most efficient way (capital structure).

👉 You can think of it like this:

- Capital budgeting = choosing the road.

- Capital structure = deciding the vehicle to drive on that road.

Importance and Significance of Capital Budgeting in Business

Every successful company, whether a tech giant, a manufacturing leader, or a retail chain, has one thing in common: they know how to invest wisely. That’s where capital budgeting comes into play. It’s not just a financial tool — it’s a strategic decision-making framework that shapes the future of an organization.

When we talk about the importance of capital budgeting, we’re really discussing the backbone of financial management. Without it, companies risk making poor investment decisions that could lock up resources for years without generating adequate returns.

Long-Term Growth and Sustainability

The most critical reason for capital budgeting in financial management is ensuring sustainable growth. Since projects often involve significant upfront costs and long time horizons, careful evaluation prevents wasted capital.

👉 Example: A company planning to expand into renewable energy must evaluate whether the investment will provide positive returns over decades. A strong capital budgeting process ensures they don’t just follow trends but make financially sound moves.

Efficient Allocation of Scarce Resources

Capital is always limited. No company has unlimited money to invest in every opportunity. Capital budgeting techniques help managers allocate funds to the projects that maximize shareholder wealth.

- High-return projects get the green light.

- Risky or low-value projects get filtered out.

This makes capital budgeting an essential filter in financial strategy.

Balancing Risk and Return

Every investment carries uncertainty. Through models like NPV, IRR, and Payback, managers don’t just see potential returns — they can also weigh risks.

- Projects with unstable cash flows can be stress-tested using sensitivity analysis.

- Inflation and tax effects can be incorporated into capital budgeting models.

👉 This ability to manage uncertainty is a major reason why the significance of capital budgeting cannot be overstated.

Strategic Alignment with Business Goals

Capital budgeting is not just about crunching numbers. It ensures projects align with long-term corporate strategy.

For example:

- A company aiming to be carbon-neutral will favor green technology projects.

- A retail brand focusing on digital growth may prioritize e-commerce platforms.

In both cases, capital budgeting decisions ensure financial resources fuel strategic priorities.

Enhancing Shareholder Value

Ultimately, the success of any financial decision is measured by its impact on shareholder wealth. Since capital budgeting decisions directly affect profitability and risk, they have a major role in building investor confidence.

Positive NPVs and high-IRR projects don’t just generate profits — they increase stock prices, dividends, and long-term valuation.

Creating Accountability in Decision-Making

Another overlooked feature of capital budgeting is accountability. By following a structured evaluation process, managers must justify why they’re recommending one project over another.

This prevents emotional, biased, or politically motivated decisions inside organizations. Instead, data and analysis take center stage.

Adapting to Inflation and Market Changes

The importance of capital budgeting also lies in its flexibility. Companies can model how inflation, interest rates, or tax changes will impact future projects. In volatile economies, this foresight is crucial for survival.

For example, when inflation is high, the real value of future cash inflows declines — making certain projects unattractive. A strong capital budgeting model reveals this before it’s too late.

Securing External Funding

Banks, investors, and venture capitalists often ask for detailed capital budgeting proposals before committing funds. A well-prepared analysis signals professionalism, reduces perceived risk, and increases chances of approval.

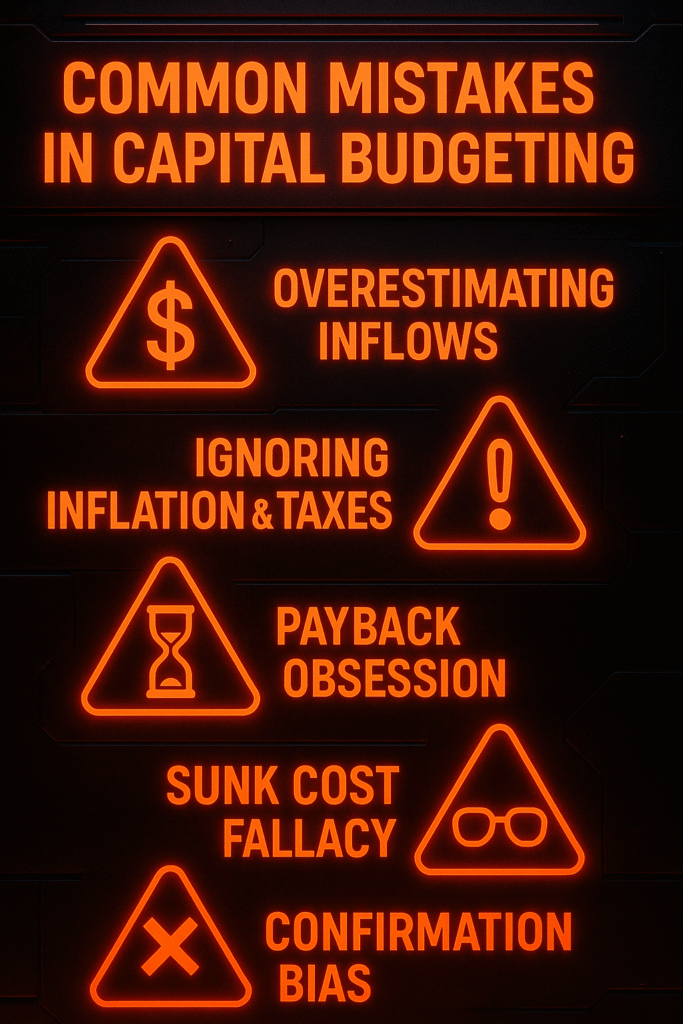

Common Mistakes and Biases in Capital Budgeting

Overestimating Cash Inflows

One of the biggest pitfalls in capital budgeting techniques is unrealistic optimism. Managers often assume projects will perform at their “best case” scenario, leading to inflated NPV and IRR values.

👉 Example: A retail chain assumes its new stores will generate $5M annually, but due to economic downturn, actual inflows are only $2.5M. The project suddenly shifts from profitable to a liability.

Fix: Always use conservative estimates and run sensitivity analysis to account for different scenarios.

Ignoring Inflation and Tax Effects

A frequent mistake is treating future cash flows as if they hold today’s value. But inflation erodes purchasing power, and taxes eat into profits.

Without adjusting for these, a project may look highly attractive when in reality, it delivers much lower real returns.

Fix: Incorporate inflation-adjusted cash flows and calculate post-tax returns in your capital budgeting models.

Payback Period Obsession

Some managers overly rely on the Payback Period method because it’s simple. But this ignores time value of money and cash flows after payback.

👉 A project with a quick payback might still be a poor choice if later years generate negative or very small returns.

Fix: Use Payback only as a supporting metric, not the sole decision-making tool. Always prioritize NPV and IRR.

Confirmation Bias in Project Selection

Executives sometimes push projects they already “believe in” and cherry-pick assumptions to make them look good. This confirmation bias undermines the objectivity of capital budgeting decisions.

Fix: Use independent review teams and standardized templates for evaluating all projects.

Sunk Cost Fallacy

Companies often continue funding a failing project just because they’ve already invested heavily in it.

👉 Example: A software company spends $50M developing a new app, but market feedback shows no demand. Instead of stopping, they pour more money in, hoping to “save” it.

Fix: Remember: Sunk costs should never influence future decisions. Only consider incremental cash flows.

Ignoring Risk and Uncertainty

A project might look financially attractive but may not fit the company’s vision. For instance, a firm focused on sustainability may reject a high-return coal project because it conflicts with long-term brand positioning.

Fix: Ensure every capital budgeting decision is evaluated not only on financial metrics but also on strategic alignment.

Short-Term Thinking

Executives under shareholder pressure may favor projects with quick payoffs, ignoring long-term value creation. This undermines innovation and growth.

Fix: Balance short-term financial pressures with long-term strategic projects that build sustainable advantage.

Conclusion

In the ever-changing world of business, one thing remains constant: companies must make smart decisions about where to invest their money. That’s exactly why capital budgeting is such a vital part of financial management. It’s more than just numbers on a spreadsheet — it’s a roadmap that determines which projects will shape the company’s future.

We’ve seen that the importance of capital budgeting goes far beyond choosing profitable investments. It ensures the efficient allocation of scarce resources, balances risk and return, enhances shareholder value, and aligns projects with long-term strategic goals. Without a structured capital budgeting process, organizations risk wasting millions on unprofitable or misaligned ventures.

Leave a Reply